許多人股票喜歡跑短線,以為台股交易成本低,

手續費僅0.1425%,證交稅0.3%,

其實不然,實際算一遍給大家看。

故事的起源是2003年我在北投上課時,

有一位同學叫阿平,從南投到北投來上課。

Many investors enjoy engaging in speculative trading, believing that the trading costs for Taiwan stocks are very low. This is due to the commission fee of only 0.1425% and the transaction tax of 0.3%. However, this assumption is not entirely accurate. Allow me to provide a detailed calculation. The story behind this issue dates back to 2003 when I was teaching in a classroom located in Beitou. One of my students, named Aping, traveled from Nantou county to attend my class in Beitou district.

阿平上課時很勇於舉手發問,

一直用技術分析觀點來挑戰我的巴菲特,

本班歡迎同學學過邪門歪道的功夫儘量使出來沒關係。

下課時跟阿平聊了一下,

他曾花了10萬元在台中拜技術分析高人為師,

自認為技術分析很厲害。

我一聽很不是滋味,因那時巴班學費才5,000元,

心想差距怎麼如此大?

堂堂武林第一大門派的巴菲特班,學費5,000元,

什麼鳥不見經傳的技術分析學費10萬元。

Aping enthusiastically raised his hand to ask questions and even challenged Buffett from a technical analysis perspective during the class. As an open and inclusive classroom, we welcomed all challenges and discussions.

After class, I had a chat with Aping. He mentioned that he had spent NT$100,000 to learn technical analysis from teachers in Taichung and felt confident in his skills. I was taken aback by the large discrepancy between his tuition and mine, which was only NT$5,000. It made me wonder why the gap was so significant. While Buffett is regarded as the first investment master, technical analysis tuition seems to be significantly overpriced and unranked in comparison.

上完課後同學一起通伊媚兒,

當時尚無討論區,用伊媚兒在討論。

阿平的伊媚兒都是前面哈拉幾句之後最後就跑出3個號碼,

問我這3家公司可否好很久?

那3個號碼都是新上櫃、獲利不到5億元的公司。

心想這傢伙故意來搗亂,

上課時特別強調上市櫃滿2年,獲利大於5億元,

阿平問的全是相反的公司。

那3家公司我完全不認識,

當時初為人師還充滿教學熱誠,

花了一下午查資料、做研究,

回信回去,1、2、3,

1、2、3,

1、2、3,

寫了9大點回去。

After the class, the students communicated with each other through emails since there was no discussion forum available at the time. In one of Aping's emails, he included three numbers at the end and asked whether these three newly listed companies were viable for the long term. However, all three companies had profits below NT$500 million, which did not meet the criteria I had emphasized in class, which was a two-year presence in the market and a profit exceeding NT$500 million. I suspected that Aping was deliberately trying to stir up trouble. As I was still passionate about teaching at the time, I spent an entire afternoon researching and gathering information on these three companies. I came up with nine points in my response and replied to Aping with the numbers 1, 2, and 3 written three times. I hoped that this would clarify my stance on the matter and provide valuable insights for the rest of the students.

2天之後來第二封信,又是哈拉幾句之後3個新的號碼出現,

我再次花一下午研究寫了9大點回去。

現在同學若要這樣做我就不理你了,

因為已沒了教學熱誠,只剩收學費的熱誠。

昨天心情比較嗨,今天就混了,

因今天沒學費可收。

同學教我「那還不簡單,就今天收一半學費,隔天再收另一半,

這樣就每天有錢收!」

我說「才不像你那麼笨咧,這樣第二天就沒人來了,」

「我應該第一天收 1 萬元,隔天退差額」

Two days later, I received a second letter from Aping, which included three new numbers after a few sentences. I spent another afternoon researching and writing down nine key points to reply. If my students were to act in the same manner, I would ignore them because my passion for teaching had been replaced by a passion for collecting tuition fees. Yesterday, I was in high spirits, but today I felt demotivated since there were no tuition fees to collect. One of my students suggested, "It's simple. Collect half of the tuition fee today and the other half tomorrow. This way, you can collect money every day!" I replied, "I'm not as foolish as you. If I did that, no one would show up the next day. Instead, I should collect the full tuition fee of 10,000 NT dollars on the first day and refund any remaining balance on the following day."

隔了2天之後又來了第三封信,我就抓狂,

不回了直接打電話問他問真的還是假的?

「問真的啊!」阿平答,

「你怎麼可能有那麼錢買那麼多股票?」我不解

「第一封信那3支股票買了沒?」,

他回「買了,已經賣了。」

「蛤!那麼快,第二封信的3支呢?」我再問,

「也賣掉了」他應,

我更吃驚「那第三封信這3支應還沒買吧?因為我還沒回。」

阿平一付輕鬆狀「沒關係,也賣掉了。」

好里佳在,第三封沒回,

才知道原來他每2到3天就換股一次。

Two days later, the third letter arrived, and it drove me crazy. Instead of replying via email, I called him and asked if he was serious about these stocks.

"Absolutely," Aping replied.

"How do you have so much money to buy all these stocks?" I inquired.

"Did you buy the three stocks from the first letter?" he asked.

"I bought and sold them," he replied.

"Oh! That was fast. What about the three stocks in the second letter?" I asked again.

"I sold those too," he responded.

I was even more surprised. "Did you buy the three stocks in the third letter yet? I haven't replied yet."

"It's fine, I already sold them," Aping said casually.

Luckily, I didn't reply to the third letter, and I found out that he changes his shares every 2 to 3 days.

問他跑來跑去有賺到錢嗎?

阿平表示「有,每年大概賺個幾萬元。」

他說他每年成交額上億元,

成交額上億元本金不用多少錢,100萬元即可,

每周買賣一次,成交額就上億元(=100萬x2x52)。

他覺得很奇怪過年時營業員都會送他禮物,

我說「當然,因為營業員賺得比你多。」

成交額1億元,手續費0.1425%,

營業員和券商即賺14萬元,比阿平賺幾萬元多。

「可是我賺最少,才5,000元,」我怒吼著

「工作卻最多!」

I inquired if Aping made money from speculative trading, to which he replied that he earns tens of thousands of Taiwan dollars annually. He claimed to have a turnover exceeding NT$100 million, which isn't difficult to achieve with a principal of just NT$1 million. With weekly transactions, turnover would surpass NT$100 million (= 1 million x 2x52). Aping was surprised that his broker gave him gifts during the New Year, but I explained that it's because the broker's income exceeds his. With a turnover of NT$100 million and a commission fee of 0.1425%, brokers and securities companies earn NT$140,000, more than Aping. I grumbled that I earn the least, only NT$5,000, but Aping remarked that it's the hardest.

當年我真的充滿教學熱誠

「來,幫你算一下一年的交易成本多高?」

阿平是2-3天買賣一次,

放寬假設每2周買賣一次,

每月買賣2次,1 年玩24次。

Back then, I was really enthusiastic about teaching. "Come on, let me help you calculate how high the transaction costs would be for a year?" Aping trades once every 2-3 days. Relaxing the assumption that trades occur every 2 weeks, buying and selling twice a month, and playing 24 times a year.

手續費0.1425%,買賣都要付,

1 年24次,一年手續費即6.8%

手續費:0.1425%x 2 (一買一賣) x 24 = 6.8%

The commission fee is 0.1425% per transaction, and it must be paid for each trade. With 24 trades a year, the total commission fee for one year would be 6.8%.

Commission fee: 0.1425% x 2 (one buy and one sell) x 24 = 6.8%

證交稅給政府的0.3%,賣時才課,

1 年24次,一年證交稅7.2%

證交稅:0.3% x 24 = 7.2%

The transaction tax is 0.3%, which is a government tax that is only charged upon selling.

With 24 transactions a year, the annual tax payment is 7.2%.

Transaction tax:0.3% x 24 = 7.2%

1 年的交易成本,手續費+證交稅等於14%。

同學知道我一年的交易成本多少嗎?

我2008年買台積電、大統益抱到2017年都沒賣,

一年交易成本是萬分2不到。

The total transaction cost for one year, including commission fee and transaction tax, is 14%. Do you know how much my annual transaction cost is? I purchased TSMC in 2008, and I did not sell it until 2017. The transaction cost for one year was only 0.02%, which is extremely low.

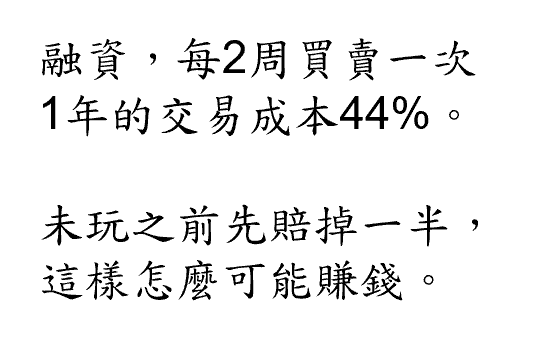

做這麼短必定融資,

融資是出4元可買到10元,成本將暴增為35%(=14% x10/4),

加上融資利息,融資利率6%,

融資利息占本金9%(=6% x 6/4),

總共的交易成本44%(=35%+9%),

未玩之前先賠掉一半,這樣怎麼可能賺錢。

It is necessary to finance speculative trading, which involves paying NT$4 to purchase NT$10 worth of stocks. The transaction cost will skyrocket to 35% (=14% x 10/4). In addition to this, there is also financing interest which is charged at a rate of 6%. This financing interest accounts for 9% of the principal amount (=6% x 6/4). Therefore, the total transaction cost is 44% (=35% + 9%). This means that half of the investment is lost before even starting the trade, making it very difficult to make any profit.

台股證交稅是世界屬一屬二的高,

之所以這麼高是因當年郭婉容課證所稅失敗,

造成股市19天無量下跌,

政府為了善後把證所稅取消併入證交稅,

由證交稅由0.15%增為0.3%。

台股證交稅裡已包含證所稅,

請蛋頭學者和政客們勿冤枉投資人賺了錢不繳稅。

Taiwan has the highest transaction tax rate in the world. In the past, former Minister of Finance Wanrong Guo implemented a capital gains tax, which led to the stock market crashing for 19 consecutive days. To rectify the situation, the government abolished the capital gains tax and increased the transaction tax rate from 0.15% to 0.3%. As a result, the capital gains tax was incorporated into the transaction tax. Therefore, egghead scholars and politicians should not blame Taiwanese investors for not paying taxes on their earnings. We have paid transaction tax.

在這種制度下,跑短線投資人最不利,

沒賺到錢卻在仍然在繳證所稅。

Under this system, speculative traders are at a disadvantageous position as they have to pay capital gains tax even before making any profits.

最後要來上一下技術分析,

本班以後將轉型成技術分析班,

學費酌予調高為10萬元,

因為學費差太多,受不了。

本班將改名為巴菲特技術分析班,

誰說巴菲特不會技術分析?

搞不好祂會,而且只有我知道祂會。

Let's conclude with a technical analysis course. In the future, this course will be converted into a technical analysis class and the tuition fee will be raised to NT$100,000. The significant disparity in tuition fees is difficult to tolerate. Moreover, we will rename this course to Buffett's Technical Analysis Class. Who said that Buffett is unfamiliar with technical analysis? Perhaps he is knowledgeable in the field, and only a few people are aware of it.

先做個市場調查,請問學過技術分析的同學舉手?

只有少數幾位,

沒舉手的都麥假,不相信都沒學過。

大家學投資的過程應該差不多,

由技術分析入門,再進入基本面分析,

我們比別人又多走一步到巴菲特領域來。

Let's conduct a market survey first. Who here has studied technical analysis? Only a few of you? For those who didn't raise your hands, you're probably just pretending because I don't believe that you haven't learned it yet. The process of learning how to invest should be similar for everyone: starting with technical analysis and then moving on to fundamental analysis. By taking this step, we are one step ahead of others in entering into Buffett's realm.

我是統計碩士,高深數學也學過一些,

初見到技術分析時倍感親切,因那是很簡單的數學,

以為可以學以致用。

I hold a master's degree in statistics and have a background in advanced mathematics, so when I first encountered technical analysis, it felt familiar to me. It involves simple mathematical operations, and I thought I could apply my knowledge to it.

1991年進證券業,92年是台股最低迷時刻,

一整天交易下來成交值曾低到40億元,

當時上市公司的獲利並普遍很差,

電子股代工訂單尚未大量進來,

只有翁大銘和雷伯龍的股票會動,

我們雖然號稱技術分析和基本面分析並重,

實在感覺不出基本面對股價到底有何關係。

In 1991, I began working in the securities industry, and in 1992, the Taiwan stock market experienced its worst moment. Despite a full day of trading, the transaction value was as low as NT$4 billion, and listed companies were generally not profitable. Large-scale electronics OEM orders had not yet arrived in Taiwan, so only stocks manipulated by big players like Daming Wong and Bolong Lei would rise. Although we claimed to focus on both technical and fundamental analysis, I did not feel that the stock price had anything to do with fundamentals.

1993年到怡富證券,台灣最大外資券商,

跟著學外資基本面分析。

外資對基本面研究要求非常嚴格,

看過怡富日本總體經濟報告,一個博士帶一個碩士寫的,

自創一些指標觀察日本經濟狀況,

其深度比台灣的台經院、中經院報告難多了。

In 1993, I joined Jardine Fleming Securities, the largest foreign securities company in Taiwan, and learned fundamental analysis from foreign experts. Foreign research departments have very high standards for fundamental analysis. I read an economic report on Japan from Jardine Fleming Japan, which was written by a doctor and a master's student. They created some indicators to observe Japan's economic situation, and their depth of analysis was much more difficult than the reports from Taiwan Institute of Economic Research and Chung-Hua Institution for Economic Research.

我們分析師早上7:00多就得到公司看報紙,

不是喝咖啡聊是非,而是跟打仗一樣,

看當天所負責的產業和公司有無發生什麼大事。

有一天一則小方塊新聞

「中華映管發生火災燒掉2條生產線」讓我跳了起來。

當年華映非常賺錢,是大同的金雞母,大同持股91%,

馬上我就得估出損失多少?何時復工?

大同獲利須調低多少?股價可能跌多少?

對大同的建議是買或賣?

整個評估須在半個小時完成,因為8:00要開會報告。

As analysts, we start our day by reading newspapers around 7:00 in the morning. It's not a leisurely coffee break, but more like a battle. We scan for any major events in the industry and companies that we are responsible for that day. One short news piece can make a huge impact. For example, when news broke that a fire had destroyed two production lines in Chunghwa Picture Tubes, I immediately jumped into action. At that time, Chunghwa Picture Tubes was a very profitable company, and it was a cash cow for Datong with 91% of the shares. I had to estimate how much loss would occur, when work would resume, how much Tatung's earnings estimate should be reduced, how much the stock price might fall, and whether to recommend Tatung to buy or sell. I had to complete the entire assessment within half an hour, because the meeting was scheduled for 8:00.

券商都會給客戶盤勢分析,

國內券商的寫法是先把本周發生的大事分析一遍,

最後結論常會冒出一句

「下周觀盤重點是Fed可能調高利率,請投資人密切觀察。」

我們研究部主管英國老外就會說,

若下周觀盤重點是Fed可能調高利率,

前面那些就不要寫了,直接把這個題目拿到前面來寫,

而且不是叫投資人密切觀察,

投資人就是不會觀察才來看你的報告,你卻叫他自己觀察。

Brokerage firms provide customers with market analysis reports, and the reports of domestic securities companies analyze what will happen in the upcoming week. The final conclusion of such a report may state that the key to observing the market next week is the possibility of the Fed raising interest rates, and investors must pay close attention to it. Our research head, who is British, would advise us to make this the main focus of the report and to elaborate on it, without distracting the readers with previous topics. We should not ask investors to observe closely, as they tend not to do so. Instead, we should present the information clearly in our report, as investors rely on us to do the analysis for them.

Fed調高利率報告要怎麼寫:

利率將調高幾碼?理由為何?

對股市的影響為何?哪些類股受創?哪些獲利?

我問主管「我又不是葛林斯潘,哪知利率會調高幾碼?」

老外說「要去假設啊,我們不在意結果對不對,

而是推理過程要合理!」

這就是外資分析師的訓練過程。

When writing a report on a potential Fed rate hike, we must answer several questions:

How much will interest rates increase and why?

What impact will it have on the stock market? Which sectors will be impacted and which will profit?

I once asked my research head, "I'm not the chairman of the Federal Reserve, how can I know how much interest rates will rise?"

The British replied, "You must make an assumption. We don't care if the results are correct, but the reasoning process should be reasonable!"

This is the training process for foreign analysts.

後來我發現外資這套基本面分析方法也是錯的,

因為用了太多的預估。

股價反應未來,我們都在看未來,都在做預測,

可是預測通常不準。

Later, I realized that even the foreign fundamental analysis method was flawed because it heavily relied on assumptions and estimations. As stock prices reflect the future, we are all essentially predicting and making assumptions about the future, but such predictions are often inaccurate.

現在認為巴菲特理論才是對的,

因祂強調要根據可知事實來做決策。

這兩天下來同學一定察覺到我在回答同學問題時

都明確告訴大家我知道什麼?不知什麼?

然後根據知道的去分析,

這才是對的,出錯的機率較低。

I now believe in Buffett's theory, which emphasizes that decision-making should be based on known facts. Over the past two days, you may have noticed that when I answer your questions, I am transparent about what I know and what I don't. Analyzing based on what we know reduces the possibility of errors.

我會技術分析,而且非常會,

只是認為技術分析都是錯的。

這樣講一定得罪了得多人,技術分析是市場主流,

有人勸我話不要講得這麼直白,婉轉一點

「方法沒有好壞能讓我們賺錢的就是好方法,

條條大路通羅馬。」

I am proficient in technical analysis, but I believe that it is fundamentally flawed. Expressing such a view may offend many people since technical analysis is widely adopted in the market. Some advise me to be more subtle and less straightforward. As the saying goes, "there is no good or bad method as long as it helps us make money. All roads lead to Rome."

條條大道通羅馬我同意,可是死巷子不會通羅馬啊,

方法當然有對錯之分,方法錯誤怎麼能賺到錢。

I agree that all roads lead to Rome, but dead-end streets won't lead to Rome. There is a right and wrong approach, and if the approach is wrong, how can one make money?

上這堂課發現要教同學新的觀念簡單,

叫同學看ROE、盈再率絕對都會去看,

可是要糾正舊思想卻是非常困難。

I found it relatively easy to teach new concepts to my students in this class. By emphasizing the importance of paying attention to ROE and PR%, the students were able to follow along. However, correcting old and deeply ingrained ideas can be challenging.

跟同學說不必在意營收、EPS,

同學反嗆「看這些有什麼錯?」,

因為這樣去買宸鴻賠了錢,

同學回來檢討不是反省他看營收、EPS,

而是推責於盈再表不能用。

上課時特別強調「宏達電、宸鴻的產品會變,

不是我們想買的公司。」

同學充耳不聞,賠了錢還把責任賴給我。

When I told my students not to focus on sales and EPS, they challenged me, "What's wrong with looking at those?" After losing money from buying shares of TPK, instead of reflecting on their own reliance on sales and EPS, they blamed the uselessness of On's table. In class, I emphasized that "HTC and TPK's products will change, not the durable companies we want to invest in." However, my students turned a deaf ear and even held me responsible for their losses.

教課之初原以為只要把方法詳細講解一遍,

同學按照要領去練,自然可學成神功,

可是執行下來卻不是這麼回事。

哥打的是一套太極拳,

同學耍出來卻像在跳街舞。

上完課之後同學都大讚這個方法很好

「以後一定用巴菲特方法選股,技術分析操作!」

說他是「左手索羅斯,右手巴菲特」,

以為這樣績效將勝過兩位大師。

錯了!這樣根本不是巴菲特神功了。

In the beginning of my teaching, I believed that if I explained Buffett's method in detail and students followed the essentials, they would naturally learn magical skills. However, this wasn't the case in practice. It felt like I was playing Tai Chi while the students were dancing hip-hop. After every class, the students praised the method, saying that they would use the Buffett method to select stocks and time their trades with technical analysis. One student even compared themselves to Soros on the left and Buffett on the right, thinking they could outperform the two masters. But this is not the true magic of Buffett's method.

很多人以為只要把各大門派功夫全學一遍,

取其精華,即能成為武林盟主。

剛好相反,反而會走火入魔,

表示哪些觀念是錯的分不清楚。

Many people think that as long as they learn all the martial arts, extract their essence, they can become the leader of the martial arts. On the contrary, they may become delusional and lose their way because they cannot distinguish which concepts or skills are wrong.

那些技術分析派終其一生都不知錯在哪兒?

所以有必要給他們當頭棒喝,讓他們清醒。

我來告訴大家技術分析錯在哪裡,

不服的人可以上來踢館。

Those who are devoted to technical analysis may never realize where they went wrong. Therefore, it's necessary to wake them up with a strong message. Let me explain what's wrong with technical analysis, and those who disagree are welcome to challenge me.

技術分析最基本的東西就是一堆技術指標,

RSI、KD值、D-MACD...等等。

近年還有一個新指標Vix,恐慌指數,

我說恐慌還需看指數,自己照照鏡子就知道了。

Technical analysis relies heavily on various technical indicators, such as RSI, KD value, and D-MACD. However, a new indicator has emerged in recent years called Vix, also known as the panic index. But do we really need an indicator to tell us when we're panicking? Sometimes, all we need to do is look in the mirror.

這些指標基本的架構是

當指標從低檔20往上交叉可以買進,

從高檔80往下叉賣出。

The general guideline for these indicators is to buy when the indicator crosses upwards from a low of 20, and to sell when it drops from a high of 80.

它的邏輯是指標往上可以買進,因為接下來股價會漲,

這是錯的,

因為技術指標是股價算出來的結果,

是股價先漲了才帶動指標往上,

指標是果,不是因,

不能再拿它來推接下來股價會漲,

錯在倒果為因。

The logic behind technical analysis is that when the indicator rises, you can buy because the stock price will rise next. This is incorrect because technical indicators are calculated based on stock prices. The stock price rises first, and then the indicator follows suit. In other words, the indicator is the result, not the cause. It cannot be used to push stock prices to rise next. Misinterpreting the indicator as the cause rather than the result confuses the cause and effect.

同學把KD值和大盤指數做對照,發現蠻相關的,

指數在低檔,KD值就在低;指數高,KD值也高。

同學說「既然相關就可以用啊,管它倒不倒果為因。」

The students compared the KD value with the market index and found a significant correlation. When the market index is low, the KD value tends to be low as well, and vice versa - when the index is high, the KD value tends to be high. The student commented, "There is a clear relationship, and it can be utilized. Not to mention the question of causality."

可不可以用?不是事後來看,而要到事前看。

如何回到事前?

很簡單,把圖的右邊蓋起來就回到事前。

請看,KD值正由低檔往上交叉,股價要漲了嗎?

The question is not whether we can use the indicator after the fact, but whether we can use it to make predictions beforehand. So how do we get back to beforehand? It's simple - cover the right side of the chart and look at the pre-event period. For instance, observe how the KD value rises from low to high. Does this mean that the stock index will rise as well ?

跌!從6,365跌到3,098,反而是跌。

自認技術分析很厲害的人,

請把股價圖右邊蓋起來看能猜對幾次?

The stock price fell dramatically from 6,365 to 3,098. For those who consider themselves skilled in technical analysis, try covering the right side of the stock chart and see how many times you can accurately predict the future direction of the stock price.

再看,這一點2,485,30年來難得的買點,

畫一條直線往下拉,KD值破40,

正值主跌段,還會加碼放空。

2,485依KD值竟加碼放空,實在離譜。

Consider the stock price at the rare purchase point of 2,485 - a level not seen in 30 years. Draw a straight line downwards and notice that the KD value falls below 40. This indicates a significant downturn in the market, and it would have been wise to short the stock during this period of major decline. However, it's important to note that at the time, the KD value suggested even more frantic short sales - an ironic observation.

技術指標還有一個盲點,股價在盤整時就會被巴來巴去,

股價大部分時間在盤整,被巴來巴去又怎樣呢?

期貨營業員曾告訴我,那一陣子指數在盤整,

客戶打電話來「技術指標又叫我要買進,

可是我已經被巴了8次。這次不曉得要不要買進?

那...那你幫我決定好了!」即掛上電話,

營業員愣在那邊「這樣算不算下單呢?」

被巴了8次就成這副德性。

Technical indicators have a blind spot, causing stock prices to fluctuate during periods of consolidation, which happens most of the time. What's the point of being tossed back and forth? Once, a futures broker told me that during a period of index consolidation, a customer called in and said, "The technical indicators are telling me to buy again, but I've been misled eight times. Should I buy this time? Then...you can decide for me!" and hung up the phone. The broker was left stunned, wondering, "Is that an order?" If you've been tossed back and forth eight times and still don't know what to do, that's the approach you're taking.

起漲型態

The rising pattern

mikeon88 發表於 2018-1-16 10:43

股價上漲一定會產生V或W底,

下跌就變成M頭,

拿支筆在紙上一畫便知,這是一句廢話

技術分析真荒謬 ! !

A stock price rise will definitely produce a V or W bottom,

If it falls, it will become an M head,

Take a pen and draw on paper and you will know that this is nonsense.

Technical analysis is ridiculous!!

同學的方法是股價便宜+起漲型態,

這樣成功的機率可能會比單純的起漲型態高些,

但會有一番爭論,

到底是預期報酬率影響較顯著,還是起漲型態?

主張這個方法的人請提出證明,別只開頭而無下文。

Jiunci Yang's method involves identifying stocks that are priced low and exhibit a rising pattern. While this approach may offer a higher probability of success compared to simply relying on a rising pattern, there may be debates as to what factors have a greater impact on investment success - expected returns or rising patterns.

Those who advocate for this method should provide evidence to support their claims, rather than simply making a statement without any further elaboration.

技術指標背離 ?

Deviation ?

今天有位同學問我,

技術指標背離代表什麼意思 ?

Today, a student asked me what "deviation" means.

技術指標設定下限為 0 ,

股價再怎麼跌,指標最低跌到 0 ,

不會變負的 ,

所以跌到後來指標就鈍化,

即所謂的技術指標背離。

Technical indicators are typically set with a lower limit of 0. This means that even if the stock price drops significantly, the indicator will not become negative as long as the lowest point is still above 0. However, as the stock price falls, the indicator may become less sensitive and less useful, which is referred to as deviation from the technical indicator.

這是公式設定必然的道理,

而非隱含了什麼不為人知的市場轉變。

只要把下限拿掉,

讓下跌可以跌到負的或無限,

就不會出現指標背離。

數學不太差的人都能理解這個道理。

This is the result produced by the formula, and does not imply any unknown market changes.

By removing the lower limit and allowing for negative and infinite values as the stock price declines, there will be no deviation in the indicator. This is a fact that can be understood even by those who are not very proficient in math.

技術分析還有一個均線理論,月線、季線、年線,

過去一個月、一季、一年大家買的平均成本。

所謂均線理論,股價站上均線會有支撐,

跌破均線則構成反壓。

Technical analysis also involves the moving average theory, which includes the monthly, quarterly, and yearly averages of the stock prices purchased by investors over the past month, quarter, or year. According to the moving average theory, when the stock price stays above the moving average, it provides support, while a break below the moving average creates pressure.

均線理論是錯的,

只要每個人都買在100元之上,股價從此就不致跌破100元?

若此,政府要護盤就簡單了,

明天政府就通令全國券商把所有股票都拿出來一賣一買一次,

讓所有股票的成本都墊高在 1 萬點之上,

從此台股就不會跌破 1 萬?

The moving average theory is flawed. Does this mean that stock prices will never fall below $100 as long as everyone buys above that price?

If so, it would be easy for the government to support the market. Tomorrow, the government could order all securities firms across the country to sell and buy all the stocks once, raising the cost of all stocks above 10,000 points. From then on, Taiwan's stock prices would never fall below 10,000 ?

當然不是這樣,因為股價不是採多數決。

假設有一檔股票百分99.9的股本都在你們手上都不賣,

我只有 1 張我來賣,用跌停板賣掉。

今天這支股票就只成交這 1 張,

我賠了10%對不對,那你們呢?

一樣賠了10%,1 張股票就讓大家賠了10%。

Of course not, because stock prices are not decided by majority vote. Suppose there is a stock in which 99.9% of the shares are held by you and your group, and you refuse to sell. I am the only one with one share and I want to sell it at the limit-down price. Today, only this one share will be traded. I lose 10%, but what about you? You also lose 10%. One share of stock causes everyone to lose 10%.

股價是少數決定多數,算籌碼面是沒必要的事,

因為股票不是錢多的人就會贏。

看外資買賣超、主力進出、政府基金沒有沒在護盤是沒必要的事。

Stock prices are decided by the minority, so calculating the chip surface is unnecessary because having more money does not guarantee winning in stocks. It is unnecessary to look at the foreign investment buying and selling, the main forces entering and exiting, and whether the government fund is supporting the market or not.

很久以前一個同學來上課,才上半天就問

「這堂課怎麼沒有教籌碼面分析?」

我解釋「一檔股票我都抱好幾年,

管它今天誰在買在賣要幹嘛呢?」

同學瞪了我一眼「你是不是不會分析?」

我怎麼不會分析,我不僅是外資分析師,

後來還作到外資研究部主管,Head of Research,

怎麼不會分析。

其實現在我就在教籌碼面分析,

教大家算籌碼面是沒必要的事。

A long time ago, a student asked me, "Why don't you teach us about chip analysis in this class?" I replied, "I have held onto stocks for several years, so it doesn't matter to me who is buying or selling today." My student gave me a skeptical look and said, "Don't you know how to analyze stocks?" Of course, I can analyze stocks. I was not only a foreign research analyst but also a former Head of Research in a foreign securities firm. However, I am currently teaching chip analysis, and I believe that it is unnecessary to focus solely on calculating the number of chips.

我一張股票就讓大家賠了10%,

我們賠掉的10%是誰賺走了?

沒人賺走喔,買我那張股票的人還沒賺錢。

股票的財富會憑空蒸發,也會從天而降,

因為股票不是零和遊戲,輸家贏家獲利加起來是零。

股票大部份股本未拿出來交易,

少數成交量決定所有人的財富。

We all lost 10% of our stock. But who made the 10% that we lost? Nobody gained any profit from it. Even the person who bought my share hasn't made any money yet. The wealth in the stock market doesn't come from nowhere, it is not a zero-sum game where the total profits of the losers and winners add up to zero. In fact, most shares are held for a long time and are not frequently traded. It is the small number of transactions that determine the wealth of everyone.

期貨才是零和遊戲,因期貨的每一口合約都拿出來交易,

有賣方一定有買方。

而且期貨是負和遊戲,

每個人出 1 元在分0.8元的遊戲,

因0.2元被期貨商和政府抽走了。

Futures trading is a zero-sum game because every futures contract is traded between a seller and a buyer. However, it is a negative-sum game where the players collectively lose more than they win. In most cases, for every $1 that is won, only $0.8 is received, with the remaining $0.2 being taken away by futures dealers and government.

負和遊戲就是穩輸的遊戲,玩到最後沒人能賺錢。

不信?我倆來玩,我當政府,你當玩家,

我每次都讓你贏,

你出 1 元,我先抽0.2元,這樣你會賺嗎?

A negative sum game is one where someone must lose, and ultimately, no one can make money. Don't believe it? Let's play a game where I am the government and you are the only player. I let you win every time, but if you pay $1, I will take $0.2 first. Will you still be able to earn anything in the end?

期貨不能玩,除了是玩猜的遊戲之外,

另一個原因是負和遊戲。

同學,本堂課正在教期貨喔,

我教大家期貨、選擇權是穩輸的遊戲,

這個觀念在學校學不到唷!

Futures are not a game for investors, mainly because they involve guesswork and are a negative sum game. In this class, we will be discussing futures and options, both of which are games that are bound to lead to losses. This concept is not typically taught in school.

負和遊戲很多,彩券就是,

大家投錢進來,政府先抽走部份,剩下的大家再去分。

拉斯維加斯的遊戲也是,

只要負和遊戲我就不玩,

去賭城連 1 個quarter的拉霸都沒拉過,

有看它的秀,還有喝免費的飲料。

There are many examples of negative sum games, such as the lottery. Everyone contributes their money, the government takes a cut, and then the remaining funds are distributed among the winners. The same goes for casino games in Las Vegas. Personally, I do not participate in negative sum games. I don't even play the slot machines in the casino. I prefer to just watch shows and enjoy free drinks.

我對電視上的老師解盤都在解外資也很感冒,

他們都是沒做過外資的人, 卻在講外資。

他們怎麼解外資「外資故意在現貨買超,

卻在期貨佈空單,再借券放空......」,

講得活靈活現,好像外資就坐在他隔壁的同事,

一舉一動都瞭若指掌。

I am quite disgusted with the TV teachers who analyze foreign investors. They have never worked for foreign companies, yet they talk about foreign investments. How do they analyze foreign investors? "Foreign investors deliberately buy more in the spot market, but they sell futures and then borrow stocks to short..." They speak so vividly, as if foreign investors are their colleagues sitting next to them.

They seem to understand every move of foreign investors.

外資是散佈在世界各地互不相干的法人,

外資在台北、東京、香港、新加坡、倫敦,愛丁堡、

瑞士、美國各地,

硬把他們的買賣超加起來解釋,

就像我跟阿土伯兩人互不認識,把我倆的買賣超加起來,

說「麥土伯」今天在幹嘛一樣的好笑,

可是電視上的老師每天這樣在解盤給我們聽。

Foreign investors are institutional investors spread out all over the world, with presence in Taipei, Tokyo, Hong Kong, Singapore, London, Edinburgh, Switzerland, and throughout the United States. Summing up their transactions to illustrate their activities is akin to adding up the transactions of Uncle Atu and me, who are strangers to each other, and then telling everyone what "Miketu" invested in today. It is absurd, yet TV teachers tell us this every day.

電視的老師更喜歡把外資妖魔化,

說外資券商出了一份買進的報告,卻反而在賣股票。

我是怡富證券電子股分析師,

寫了一份買進報告,客戶反而賣出,何故?

很簡單,他不buy我的story罷了。

股票不是怡富賣的,是客戶,加州教師退休基金經理人賣的。

不是分析師寫的報告客戶就言聽計從,

基金經理人每天桌上會收到一疊研究報告,

我的報告也僅是其中一本。

TV teachers prefer to demonize foreign investors. They claim that foreign brokerage firms issue buy recommendations while selling stocks. However, as an electronic analyst at Jardine Fleming, I know that this is not always the case. For instance, I wrote a report recommending overweight, but some of our clients sold their shares. Why? Simply put, they didn't agree with my analysis. Jardine Fleming doesn't sell shares; our clients, such as the fund managers of California Teachers Pension, do. These clients receive numerous research reports daily, and my report is just one of many. As such, they won't necessarily follow every analyst's recommendation.

有人說天王分析師?

在我那個年代也是天王分析師,

怡富是台灣最大外資券商,一半外資在我們公司下單,

當年電子股最紅,

我是當時台灣薪水最高的分析師。

Are you asking if I'm a star analyst? Well, I'm not just a star analyst, I'm a superstar analyst. Jardine Fleming is the largest foreign brokerage firm in Taiwan, with half of all foreign investors placing their orders through us. During that time, electronics stocks were the most popular, and I was the highest-paid analyst in Taiwan.

我寫一本產業報告,推薦10家電子股,8家被外資買到滿,

當年外資持股有上限只能買到股本的10%。

那時在看盤就覺得奇怪怎麼我推薦的股票動不動就在漲停板?

原來都是我們家客戶買的。

I wrote an industry report recommending 10 electronics stocks, out of which 8 were fully bought by foreign investors. During that time, the foreign shareholding limit was 10%. When I checked the stock quotes, I was amazed to see that my recommended stocks often hit daily limits. Later on, I discovered that it was because our clients had purchased them.

有一次去財訊聽老謝演講,

他提到台股正流行外資概念股QFII Play,

他說外資很看好電子股,然後就一路唸,

外資估2301光寶今年EPS、明年EPS多少,

2302麗正多少,一路唸到最後一支。

心想他在唸什麼?越聽越耳熟,

原本他在唸我估的EPS,

這樣我算不算天王分析師!

One day, I attended a speech by Jinhe Sie at Wealth magazine. He mentioned the growing popularity of QFII play, qualified foreign institutional investors play, in the Taiwan market. He said that foreign investors were very bullish about electronics stocks, and he read out some estimated EPS figures loudly, including those for 2301 Lite-On and 2302 Rectron. As I listened, I realized that he was reading my estimated EPS figures. In this way, I am regarded as a king analyst !

有人說,外資喊的目標價都亂喊,不是喊太高就是太低。

外資目標價並未亂喊,

請問宏逹電漲到1,300元喊1,500元亂喊嗎?

很保守的喊吧。

喊100元的才是亂喊,雖然後來他對了。

Some people say that foreign investors' target prices are all arbitrary and either too high or too low. However, foreign investors do not randomly shout out target prices. For example, when the price of HTC rose to NT$1300, was it really arbitrary to set the target price at NT$1500? It was a conservative estimate. On the other hand, setting the target price at NT$100 was arbitrary, even though the person who did so turned out to be right later on.

何以如此?因市場上大部分人都是看趨勢,

看趨勢有一個偏差,越漲越看好,越跌越悲觀。

漲到1,300當然看1,500。

不像我們價值投資,越漲越覺得貴,

跌低了反而高興可撿便宜。

只是價值投資者在市場上是少數。

Why is this? It's because most people in the market tend to focus on trends. However, there is a bias in following trends. The more the market goes up, the more optimistic people become, and the more it goes down, the more pessimistic they become. When a stock rises to 1,300, it will undoubtedly raise the target to 1,500. Unlike value investors who believe that the more a stock rises, the more expensive it becomes, most investors tend to follow the market trend. If a stock falls, value investors are usually happy to take advantage of the opportunity to buy at a bargain price. However, value investors are a minority in the market.

技術分析還有一個東西叫價量理論,

股價在低檔量會縮,高檔量增。

的確股市存在這個現象,

可是股價反轉向下或回檔的過程中量都會縮,

兩者動作不同,前者要賣,後者則是買。

量縮了究竟是反轉或回檔事先無法判斷,

仍是無用的指標。

There is one thing in technical analysis called price volume theory.

When price is low, transaction volume will decrease, and when price is high, transaction volume will increase.

This phenomenon does exist in stock market.

However, whether stock price falls or is corrected, trading volume will decrease.

Actions of the two are different. The former is for sale and the latter is for purchase.

It is impossible to predict in advance whether reduced trading volume is a price drop or a correction.

Still a useless indicator.

所以我才會說技術分析通通是錯的,

其它沒講到的技術分析,像波浪理論,

什麼1-2-3-4-5-A-B-C波,

我住在淡水,每天看波浪,就看不出有啥1-2-3波。

That's why I say technical analysis is completely wrong. There are other technical analysis concepts, such as wave theory, and the 1-2-3-4-5-A-B-C wave that I haven't mentioned. I live in Tamshui and observe the ocean waves every day. However, I can't see any evidence of 1-2-3 waves.

講這麼多就是還有人誣我不懂技術分析才會說人家錯,

為了證明我真的很懂,

現在就用純粹的技術分析來報一支明牌給各位,

以答謝同學這二天來上課。

I've explained so much, yet there are still people who wrongly accuse me of not understanding technical analysis and claiming that it's all wrong. To prove that I really understand. Now, I will use pure technical analysis to make stock tips to thank my students for coming to class these two days.

報明牌囉,注意聽喔。

這支股票在高檔整理完成,強勢整理。

股價站上均線,跳空上漲,攻擊量出現。

這一支有主力住在帝寶,我跟他的兒媳婦蠻熟的,

她在台灣的節目剛收掉,前往中國發展。

公司派全力作多。這是哪一家?

下周要發動囉,請作筆記。

Please take note that stock tips will be provided soon. The stock price has been consolidating at a high level and consolidating strongly. It rose above the moving average, the gap jumped, and there was an increase in trading volume. Moreover, a big player living in Mansion Dibao is highly involved in this stock. I happen to know his daughter very well, and she just recently finished her TV program and went to China. The company also appears to be very optimistic. Can you guess which stock this is? Keep an eye on it as it is expected to surge next week.

基亞,崩盤前的基亞就長這樣,

完全符合技術分析飆股的要件,

結果是崩盤,

那些會技術分析的人請上來解釋看看。

Before the crash, Medigen Biotech (3176.TW) had met all the technical analysis requirements for a soaring stock, but it still crashed. Can someone who understands technical analysis explain why this happened ?

有一次上到這裡,同學睡眼惺忪舉手問:

「麥可,你說這支股票下周要發動,是真的假的?」

把我嚇出一身冷汗!

Once during a class in this section, a drowsy student raised her hand and asked, "Michael, is it true that the stock you mentioned will surge next week?" It gave me a fright and I broke into a cold sweat!

都瞭解了嗎?有沒有問題?這堂課將進入尾聲,

如果上了兩天完全聽不懂,沒關係,

如果已睡了兩天的覺,請醒過來。

Do you all understand ? Any question ? This class is about to end.

If you still don’t understand after two days, it’s fine.

If you have slept for two days, wake up.

第一,未來不管聽到多大的明牌,買股之前請先按盈再表。

選股原則就3點:

1. 選高ROE、配得出現金,不會變的公司

2. 便宜買,一路抱到貴才賣

3. 買至少100支股票,不必照顧也不要停損

Firstly, no matter how promising a stock tip may seem, always On's table before making any purchases.

Our stock selection is guided by three principles:

1. We select companies with high return on equity, high dividends payout, and a stable business model.

2. We buy at a cheap price and hold until the stock becomes pricey.

3. Maintaining a diverse portfolio of more than 100 stocks eliminates the need for constant monitoring and loss cutting.

第二,不要猜測大盤趨勢,依GDP按表操課加減碼。

- 講稿 1/21:歡迎 (Lecture 1/21 Welcome)

- 講稿 2/21:知與不知 (Lecture 2/21 Knowable and unknowable)

- 講稿 3/21:巴六點 (Lecture 3/21 Buffett's Six Criteria)

- 講稿 4/21:物美價廉 (Lecture 4/21 Good quality and low price)

- 講稿 5/21:還原股價 (Lecture 5/21 Adjusted stock price)

- 講稿 6/21:高ROE (Lecture 6/21 High ROE)

- 講稿 7/21:配得出現金 (Lecture 7/21 High dividends)

- 講稿 8/21:會計 (Lecture 8/21 Accounting)

- 講稿 9/21:地雷股 (Lecture 9/21 Landmine stocks)

- 講稿 10/21:他們通通是錯的 (Lecture 10/21 They are all wrong)

- 講稿 11/21:不會變的公司 (Lecture 11/22 Durable)

- 講稿 12/21:多種果樹 (Lecture 12/21 Diversification)

- 講稿 13/21:IRR (Lecture 13/21 IRR)

- 講稿 14/21:殖利率陷阱 (Lecture 14/21 Yield trap)

- 講稿15/21:GDP理論 (Lecture 15/21 GDP Theory)

- 講稿 16/21:全世界都成立 (Lecture 16/21 Globally applicable)

- 講稿17/21:不要想太多 (Lecture 17/21 It's not that deep)

- 講稿 18/21:玩融資期貨選擇權是悲劇的開始 (Lecture 18/21 Margin trading, futures and options are the beginnings of a tragedy)

- 講稿 19/21:基金太貴,不做代操 (Lecture 19/21 Funds are too expensive, don’t manage other's funds)

- 講稿 20/21:股債不是蹺蹺板 (Lecture 20/21 Stock debt is not a seesaw)

- 講稿 21/21:技術分析真荒謬 (Lecture 21/21 Technical analysis is ridiculous)

沒有留言:

張貼留言

注意:只有此網誌的成員可以留言。