如何找到高ROE的股票?

第一步觀察過去5年ROE的趨勢,

第二能夠配得出現金的公司才夠維持ROE。

Finding stocks with high ROE can be accomplished by following these steps:

Observe the trend of ROE over the past 5 years.

Look for companies that can afford to pay cash in order to maintain a high ROE.

當公司獲利衰退了如何維持高ROE?

把分母的淨值降下來。

淨值包括保留盈餘和股本,

把保留盈餘配出來就是配息,

把股本配出來即減資。

減資跟配息都可以讓淨值降下來,

進而維持住高ROE。

Maintaining a high ROE when profits decline can be achieved by reducing the net assets in the denominator of the ROE calculation. Net assets include retained earnings and capital. Allocating retained earnings as dividends and returning capital can both decrease the net assets, resulting in a higher ROE.

為什麼維持高ROE這麼重要?

因為若不能維持高ROE股價將跌得很慘!

ROE下降,本益比跟著下修,即負的倍數效果,

股價會跌得很慘。

Maintaining a high ROE is crucial because a decrease in ROE can lead to a significant drop in the stock price. If ROE cannot be sustained, the PER will decrease, leading to a negative multiple effect and causing the stock price to plummet.

假設有一家公司EPS從3元衰退成2元,

造成ROE從20%降到13%,

本益比跟著同幅度往下降,

從10倍降到7倍,股價將跌54%,

獲利僅衰退1/3,反應到股價卻跌了54%,

因為ROE下降,本益比被往下修正。

If a company's EPS decreases from $3 to $2, it could lead to a drop in ROE from 20% to 13%. This decrease in ROE would cause the PER to fall from 10 times to 7 times, resulting in a 54% decrease in stock price. Despite the profits only declining by a third, the decrease in ROE causes the PER to decrease, leading to a 54% drop in stock price.

這很嚴重,因為獲利衰退很常見,要如何挽救股價?

問題出在哪裡?因本益比往下修正,

如何才能不讓本益比往下修?

維持住ROE即可,

獲利衰退了如何維持ROE?

把分母的淨值減下來,減資和配息都可以,

從15元減到10元,即便獲利仍只有2元,ROE回升到20%,

本益比跟著同幅度回升由7倍到10倍,

反應到股價只會跌17%,比原來跌到54%就好很多。

This is a critical issue, as profit declines are a common occurrence. The problem lies in the decrease in the PER due to a decrease in ROE. To prevent the PER from declining, it is essential to maintain a high ROE. If profits decline, the ROE can be sustained by reducing the net assets in the denominator of the ROE calculation. Both returning capital and paying dividends can help decrease the net assets. For example, if the net assets decrease from $15 to $10, even if the profits remain at $2, the ROE will increase to 20%. This will cause the PER to rise from 7 times to 10 times, leading to a much smaller 17% decrease in stock price compared to the original 54% drop.

獲利衰退沒有關係,把多餘的現金配出來維持住ROE,

股價就不會跌得那麼慘!

Even if profits decrease, allocating excess cash to maintain a high ROE can prevent a significant drop in stock price. By doing so, the impact of a profit decline can be mitigated.

以上是假設例子,實際上這樣做的是晶華酒店,

2000年淨利8.98億元後來降到6億多元,

造成ROE從18%降到13%。

晶華在2002年把股本從43.13億元減為21.56億元,

減資一半,

之後3年又大量配息,

減資和配息兩件事都做,

目的把ROE從13%拉回到27%,

股價如何反應?

The above is a hypothetical example, but in reality, it was the Regeant Hotel that carried out this action. In 2000, the net profit declined from NT$8.98 billion to more than NT$6 billion, causing the ROE to drop from 18% to 13%. In 2002, Regeant reduced its capital from NT$43.13 billion to NT$21.56 billion, effectively halving its capital. Over the next three years, a substantial amount of dividends were distributed. The aim of reducing capital and distributing dividends was to bring the ROE back up from 13% to 27%. What was the stock price reaction?

減資的第一天開盤時交易所會把股價調高,為什麼?

因減資前後股東財富不變,

減資股數減少,股價提高。

之後3年又大量配息,ROE從19%回升到27%,

ROE回升,本益比跟著上升,股價一路往上漲。

晶華酒店總共3度減資,股價曾登上股王。

The exchange raises the stock price when the market opens on the first day of return of capital because despite the reduction of capital, shareholder wealth stays unchanged. The decrease in the number of shares leads to an increase in stock price. Over the next three years, substantial dividends were distributed and the ROE increased from 19% to 27%. The improvement in ROE and a rise in the PER sustained the upward trend of the stock price. Regeant Hotel has undergone three capital reductions in total and was once known as the king of stocks, having the highest stock price among all stocks.

國巨為第二例,多次減資和大幅配息之後,

ROE由3%上升到14%,股價大漲。

Yageo is the second example. Following several reductions in capital and significant distributions of dividends, ROE increased from 3% to 14% and the stock price rose dramatically.

晶華酒店和國巨是賺錢的公司辦減資,

稱為現金減資。

Regent Hotel and Yageo are profitable companies that practice reduction of capital, also known as reduction of cash capital.

在以往比較常見的是虧損的公司辦減資,

上市櫃辦法規定每股淨值小於5元就得下市下櫃,

打入全額交割股。

假設有一家公司股本100元,虧損60元,

每股淨值剩4元就得下市,

請問如何讓股票繼續掛牌?

It was a common occurrence for companies that were making losses to decrease their capital. The listing regulations specify that if the NAV drops below NT$5, the company must be taken off the stock market and traded as fully delivered shares. For example, if a company has a capital of NT$100 and a loss of NT$60, and its NAV falls to NT$4, it will need to be delisted. How can the company ensure its stock remains listed ?

虧損無可改變,但可以動什麼手腳?

只要減資6成,股數從10股減為4股,

每股淨值就回升到10元,

股票即能繼續掛牌,

公司還是虧損,股票卻可繼續掛牌。

The loss cannot be altered, but what actions can be taken? By reducing the capital by 60%, the number of shares will decrease from 10 to 4. If the NAV rebounds to NT$10, the stock can continue to be listed. Although the company is still making losses, the stock can remain listed.

虧損公司減資,股本繳回去註銷掉,

沒有股本可退還,因已虧掉了,

請問這樣股東財富有沒有減少?

一樣沒有!因減資前後股東財富不變。

減資不管是賺錢或虧損公司辦減資

都不會讓股東財富減少。

The loss-making company reduces its capital and writes off its capital. No cash is returned to shareholders as it has been lost. Will this decrease the wealth of the shareholders? No! The wealth of shareholders remains unchanged before and after the return of capital. Reducing capital, whether the company is profitable or loss-making, does not decrease the wealth of the shareholders.

威盛先減資再增資,請問為什麼如此?

威盛是一家虧損累累公司,需要股東再給它錢,

可是眼看即將要被下市,

一旦下市誰要去認它的現金增資。

所以要先減資來確保上市地位,

才能辦現金增資去跟股東要錢。

VIA first decreases and then increases its capital. The reason for this is because as a loss-making company, VIA requires additional funds from its shareholders. However, with the threat of delisting, there may be few willing participants in its rights issue. Therefore, the company must first reduce its capital to maintain its listing status, and then it can ask its shareholders for money through a rights issue.

美股的下市規定是看股價

一段期間之內低於 1 美金就得下市,

OTC則無此規定。

花旗銀行(C)2011年股價一度跌到 1 美金,眼看即將要被下市,

趕緊把股票10股合併成 1 股,股價回升到10元繼續掛牌。

股票合併又叫做反分割(reverse stock split)。

The rules for delisting of US stocks are based on stock prices. If a stock's price falls below $1 for a specified period, it may be delisted. On the other hand, this requirement is not applicable in the OTC market. In 2011, Citibank's (C) stock price fell to $1 and was in danger of being delisted. To maintain its listing status, the company conducted a reverse stock split, merging 10 shares into 1 share, which resulted in a stock price increase to $10.

美股股票分割股數表示方式跟台股除權不一樣,

台股除權之後股本才會增加,

美股分割之後連同前面幾年的股數也同時分割,

純粹從股數這一欄來看,看不出是哪年分割的。

下圖可口可樂2012年股票1股拆成2股之後,

連同前面幾年的股數也一併分割。

In terms of stock splits, US stocks are expressed differently from Taiwanese stocks after an ex-rights issue. In Taiwan, capital only increases after ex-rights, whereas in the US, a stock split affects all shares, including those from previous years. It is not possible to determine in which year a split occurred based solely on the number of shares column. As shown in the picture below, after 1 share of Coca-Cola stock was split into 2 shares in 2012, the number of shares from previous years was also divided at the same time.

配得出現金的公司才能夠維持住ROE,

這是好公司很重要的特徵。

台積電、中鋼、台塑這三家都市場上公認的好公司,

雖然都屬於資本密集產業,

賺了錢之後需要去買更多的機器設備來擴廠,

可是仍然配得現金出來,而且還很少辦現金增資,

因為運轉效率更好可以賺更多錢來配息。

能夠配得出現金是好公司重要特徵,

在茫茫股海若不曉得怎麼選股?

就從高配息的股票去選就對了!

Only companies that can pay dividends can maintain their ROE, which is an important characteristic of a good company. TSMC, China Steel, and Formosa Plastics are all recognized as excellent companies in the market, even though they are all capital-intensive industries. Despite needing to buy more machinery and equipment to expand their factories, they still manage to pay dividends and rarely raise funds through rights issues. This is because their higher operational efficiency allows them to make more money to pay dividends. The ability to pay dividends is a crucial aspect of being a good company. If you're unsure of how to choose stocks in the vast stock market, choosing high-dividend stocks is a good place to start.

相反的,公司一天到晚跟股東要錢,

常常辦現金增資和可轉換公司債(CB)就是利空。

高僑做倉儲自動化設備的公司,

2006年時還不錯,同學在推薦,

按盈再表一看的確不錯,獲利快速成長,ROE高,

同時看了個股新聞,在股價漲高時公司宣布辦現金增資,

預計募進14億元,當時淨值才13億元,淨值大增 1 倍。

看到這則新聞我即跟同學警告這是利空。

On the contrary, companies that continually ask shareholders for money, often through rights issues or convertible bonds (CBs), are considered red flags. Take Auto Tech (6234.TW) as an example, which specializes in automation equipment for warehouses. A student recommended the company to me in 2006 and it appeared to be performing well with its growing earnings and high ROE. However, when I read a news article announcing the company's plan to raise 1.4 billion dollars through a rights issue at a high stock price, I advised my student that this was a negative sign as the company's net worth was only 1.3 billion dollars and expected to double.

後來高僑獲利還衰退,ROE劇降,本益比往下修正,

股價一路慘跌,從最高140元跌到10元。

何以致此?

2006年是景氣還不錯的一年,

高僑產能滿載想辦現金增資來擴廠,

不料現增辦完之後景氣從此一去不復返,

公司獲利衰退,可是淨值增加 1 倍,ROE崩壞,

高僑在景氣高點辦了一個不該辦的現金增資。

Subsequently, Auto Tech's profits declined, its ROE plummeted, and its price-to-earnings ratio (PER) also decreased. Its stock price dropped dramatically, from a high of NT$140 to NT$10. This happened because 2006 was a peak year for the company. Auto Tech had reached full production capacity and decided to issue rights to raise funds for expanding its production. Unfortunately, after the expansion was completed, the boom did not return as expected. As a result, the company's profits fell, but its net assets doubled and its ROE plummeted. It would have been better for Auto Tech to not raise funds through a rights issue during the peak of the business cycle.

大額的現增是利空,

所謂大額,我規定指超過淨值1/2以上,

是淨值,不是股本。

A large rights issue is negative. By large, I mean an amount greater than half of the company's net assets, not capital.

現金增資募了多少錢自己要會算,新聞上不會每次都給答案。

高僑的新聞只寫要辦現金增資1.2億元,溢價118元發行,

這是什麼意思?

現金增資1.2億元是發行1.2 億元÷10這麼多股數,

因股票面額10元。

溢價118元,所謂溢價指超過10元以上,

可是一股是賣118元,不是128元,這是習慣性的說法。

所以1.2億 ÷ 10 x 118 = 14億元。

You have to calculate the amount of money raised by the rights issue yourself, as the news won't always provide the answer. For instance, Auto Tech's news only stated that they will issue rights worth NT$120 million at a premium of NT$118. This means the capital increase will be NT$120 million, or 1.2 million shares at a face value of NT$10 each. The premium of NT$118 refers to a price higher than the face value of NT$10 per share, so each share will be sold for NT$118, not NT$128. Hence, the total amount raised would be (NT$120 million / NT$10) x NT$118 = NT$1.4 billion.

大額現增指超過淨值1/2以上,

所謂淨值是母公司淨值。

潤泰全現金增資募了65億元,

65億元有沒有超過淨值1/2?

A large amount of rights issue is defined as being more than half of the net assets of the parent company. For example, when Ruentex Industries (2915.TW) raised NT$6.5 billion through a rights issue, it is necessary to determine if this amount exceeds half of the company's net assets.

盈再表抓的財報是合併報表,

什麼是合併報表講稿8/21會解釋。

這個淨值是合併淨值,

母公司淨值=合併淨值-少數淨值

65億元剛好超過母公司淨值1/2,是利空。

消息一宣布當天股價就大跌!

The financial report obtained from On's table is a consolidated statement, which will be explained in Lecture 8/21. These net assets refer to consolidated net assets, and the net assets of the parent company can be calculated as the consolidated net assets minus the minority net assets. The NT$6.5 billion raised through a rights issue by Ruentexind (2915.TW) is slightly more than half of the parent company's net assets, which is viewed as negative news. The stock price dropped immediately upon the announcement of this news.

荷蘭皇家電信也辦了一個現金增資募40億歐元,

原先淨值才21億歐元,增加近2倍,股價大跌41%。

Koninklijke KPN N.V. (KKPNY) also raised 4 billion euros through a share issuance. Its original net assets were only 2.1 billion euros, meaning the increase was nearly double. As a result, the stock price dropped by 41%.

這裡值得一提的,賺錢的公司淨值一定是正的,對不對?

應當無庸置疑,

有無可能賺錢的公司淨值突然變成負的?

沒發生火災,未被掏空,

有可能,買回庫藏股就是。

假設有一家公司股數2股,EPS 5元,淨值30元,

2股 x 10 + 5EPS x 2 = 30淨值

買回 1 股庫藏股,股價50元,淨值變成 -20元,

30 -1庫 x 50 = -20

賺錢的公司會因為買回庫藏股買到淨值為負。

It's important to note that the net assets of a profitable company should always be positive. This is correct. However, if a profitable company buys back its own stock, its net assets may become negative.

For example, if a company has 2 shares with $5 EPS and $30 net assets,

$30.2 shares x $10 + $5 EPS x 2 = $30 net assets

after buying back one treasury stock at $50 per share, the net assets would become negative at -$20.

$30 -1 share x $50 =-$20

The buyback of treasury stocks by profitable companies can result in negative net assets.

買回庫藏股是減資的一種,跟減資有何不同?

減資是所有股東的一律被減,

買回庫藏股則為公司到市場上買回股票,

沒有賣的人股票不會減少,而且股權比例來還會上升。

The repurchase of treasury shares is a type of capital reduction, but how does it differ from capital reduction? Capital reduction uniformly reduces the shares of all shareholders, while the buyback of treasury shares involves the company purchasing its own stocks from the market. This results in a higher ownership ratio for those who have not sold their shares.

美股只要公司宣布買回庫藏股價就會應聲大漲,

因EPS上升,股價跟著上漲。

前面所述ROE上升,本益比跟著上升,

兩個程度上不同。

買回庫藏股註銷掉,股數減少,EPS上升,股價一定漲。

US stocks experience a sharp rise as soon as the company announces its plan to buy back its treasury shares. This is due to an increase in earnings per share (EPS), which causes a corresponding rise in stock price. As previously mentioned, the ROE also increases and so does the price to PER, although the degree of change may vary. When the company buys back and cancels its treasury shares, the number of shares decreases, causing an increase in EPS and a definite rise in stock price.

美股買回庫藏股一律註銷掉,

台股則除了註銷之外,也可轉給員工分紅,

分紅股數未減則EPS不變,股價不會漲。

台灣就是這點討厭,抄別人制度不好好抄,

抄回來後硬要補上 1 點或 2 點。

國外三權分立可以用,補上2權成五權就不能用。

台灣買回庫藏股加上可給員工分紅,

就不知股價會不會漲?

得去看新聞稿,上面會註明。

In the US, all buybacks of treasury stock are cancelled. In Taiwan, besides cancellation, they can also be distributed as employee bonuses, which keeps the number of shares unchanged and has no effect on EPS or stock prices. Taiwan has a tendency to adopt systems from other countries, but with modifications, such as the addition of two more powers to the three-power political system, making it more complicated. The outcome of the buyback of Taiwanese treasury stock combined with employee bonuses is uncertain. Check the news release for further information.

幾年前智原曾宣布買回庫藏股,

事後查其執行率為 0,沒買回半張。

問會計師,他說「因為那沒有罰則,

頂多下次再辦時主管機關K一下而已」。

公司宣布買回庫藏股可以不買,

像浩鼎、樂陞都是虚晃一招。

A few years ago, Faraday Technology (3035.TW) announced a plan to repurchase treasury stock, however, no repurchases have taken place since the announcement. When I asked my accountant, he said "Because there's no fine, the authority will only give a slap on the wrist at most." The company's announcement to repurchase treasury stock may have been a feint, similar to OBI Pharma (4174.TW) and XPEC Entertainment (3662.TW).

美股很常見買回庫藏股。

當公司手上現金太多,沒有其他投資機會,

股價又太低時就去會買回庫藏股,

因為買庫藏股沒有繳稅的問題,

配息股東要繳稅。

Repurchasing of treasury shares is a common practice among US stocks. Companies engage in this when they have an excess of cash, lack of other investment opportunities, and the stock price is cheap. The repurchasing process doesn't have any tax implications, however, shareholders will be taxed when they receive dividends.

盈再表上的配息率是股息加上買回庫藏股。

美股配息不只一年配一次,也可以半年配或季配都可以。

The payout ratio in On's table includes both dividends and repurchased treasury shares. In the US, dividends are not limited to once-a-year distributions, they can also be distributed on a semi-annual or quarterly basis.

對公司來講何時應買庫藏股,何時該減資或配息?

股價便宜應買回庫藏股,

不便宜則減資或配息。

宏達電在2011年股價900元宣布買庫藏股是錯的,

因為900元貴。

The company must decide when to buy back treasury shares and when to reduce capital or distribute dividends. If the stock price is cheap, it is a good idea to buy back treasury shares. However, if the stock price is expensive, reducing capital or distributing dividends may be a better option. In 2011, it was not a wise decision for HTC to buy back treasury shares at a price of NT$900 as it was considered expensive at that time.

買回庫藏股買到淨值為負,表示負債比是多少?

負債比=負債÷總資產,

資產100元,淨值-20元,負債比是120%,

資(100)=債(120)+值(-20)

負債比超過100%表示公司在做沒有本錢生意,

開公司自己完全不出錢,全部靠舉債,

身為股東不用出錢,公司每年還賺錢回來,這是最好的公司,

天底下還什麼比這更好的事!

什麼樣的公司才可以如此?

收現金的公司,巴菲特班就是。

我開這個班最大的費用是租教室的租金,2天要32,000元。

只要確定有6位新生報名,就可以去借錢來繳房租,

收到學費之後還掉負債,剩下的錢全部都是我賺的。

開這個班完全不用出自己的錢,

本班沒有應收帳款,給我應收帳款就把你踢出去!

The repurchasing of treasury stocks will result in a decrease in net asset value.

Debt ratio = debt ÷ total assets

Assets are $100, net assets are -$20, and the debt ratio is 120%.

This can be represented as:

A ($100) = L (120%) + E (-$20)

A debt ratio greater than 100% signifies that the company is operating without any personal investment and solely relying on debt. Starting a company does not necessitate shareholder's funding and the company still generates profits each year. This type of company is considered exceptional and there is nothing better. Such a business model is referred to as a cash cow company, similar to the Buffett Lecture Series.

The Buffett Lecture Series is a business model that yields cash flow. The primary cost of starting this course is the rental fee for the classroom, which is NT$32,000 for two days. If I can secure enrollment from at least six new students, I can obtain a loan to pay for the rental fee. After receiving tuition, I can pay off the debt and retain all the profits. This means I won't have to contribute any personal funds for this course. This course does not accept accounts receivable and anyone who tries to extend credit will not be allowed to participate.

美股可以找到一堆淨值為負的公司,

康寶濃湯(CPB)、麥當勞(MCD)、Clorox、穆迪(MCO)、

百勝客(YUM)都是,百勝客為披薩哈和肯德基的母公司,

這些公司一看就知都是收現金的。

在台股找不到這種公司,不是公司做不到,

而是公司法不允許這樣做。

公司法規定買回庫藏股只能買到淨值一定比例。

In the US stock market, there are several companies with negative net assets, such as Campbell Soup (CPB), McDonald's (MCD), Clorox (CLX), Moody's (MCO), and Yum! Brands (YUM), the parent company of Pizza Hut and KFC. These companies are easily recognizable as cash cows. However, this type of company is not allowed in the Taiwanese stock market due to company laws which prohibit the purchase of treasury stocks that exceed a certain percentage of net assets.

Clorox是我去牙醫家上課時跟我說的一家公司,

全美的牙醫都用它的消毒藥水。

它的淨水器叫Brita,電視有在打廣告,德國的公司。

它每年都賺錢,可是有兩年的淨值為負,因買回庫藏股。

A dentist introduced me to Clorox during a lecture at their home. Dentists across the US use its disinfectant products. Its water purifier brand, Brita, is advertised on television and is a German company. Despite making a profit every year, Clorox has had a negative net asset value for two years due to its repurchase of treasury stocks.

賺錢的公司淨值為負,ROE不能算,

改用EPS算貴淑價。

便宜價=EPS x 本益比12倍,

貴價=EPS x 本益比30倍。

When a profitable company has a negative net asset value, the traditional ROE calculation cannot be used. In such cases, EPS is a more appropriate method.

A stock is considered cheap when its price is equal to the EPS multiplied by 12 times the PER.

A stock is considered expensive when its price is equal to the EPS multiplied by 30 times the PER.

負淨值公司無法由ROE評估經營績效,須改看ROA,

母ROA = 母淨利/母資產

合併報表的資產為母子公司合計,

故須依母淨值與子淨值比重概略分出母資產以利計算

Companies with negative net assets cannot accurately assess their operating performance using ROE and should switch to ROA instead.

Parent ROA = parent net profit/parent assets

In a consolidated statement, assets include the total of both parent and subsidiary assets. To calculate ROA, it is necessary to roughly allocate parent assets based on the proportion of parent net assets and subsidiary net assets.

能夠配得出現金才維持住ROE,

下一步如何才能配得出現金?

現金不是想配就配得出來,

不是賺了錢即配得出現金,

有些公司即便賺到錢一樣配不出現金,

因要買更多機器設備去擴廠。

A high ROE can be maintained by companies that are capable of paying high dividends. The next consideration is how the dividends are distributed, which is not done randomly. Some profitable companies may choose not to pay dividends as they need to retain the funds for expanding production capacity.

盈再率低的公司才配得出現金,

盈再率即盈餘再投資率,

其公式分子=固資4+長投4-固資0-長投0,

第4年的固定資產加長期投資減第0年的,

第0年就是第 1 年的前一年,

或者可想成2004減掉2000年,4減0才有4年。

4年來增加了多少固資和長投占盈餘比重,

即資本支出占盈餘比重。

Companies that have a low profit reinvestment rate (PR%) can offer high dividends.

The numerator of the PR% formula is calculated as follows:

(Fixed Assets in Year 4 + Long-Term Investment) - (Fixed Assets in Year 0 + Long-Term Investment).

This reflects the increase in fixed assets and long-term investments as a proportion of profit over a 4-year period, representing the proportion of capital expenditures in relation to profit.

為何每4年算一次?

因為景氣循環電子股3年一個循環,

傳統產業5年半一個循環,

為求一致取4年。

盈再率就是公司每賺100元要再投資多少錢去買機器設備,

比率低的公司比較可能配出現金。

Why is the PR% calculated every four years? The calculation is based on an average of the business cycle, which is three years in the electronics industry and five and a half years in traditional industries. PR% represents the amount of money a company must invest in machinery and equipment for every $100 in profits. Companies with a lower PR% are more likely to pay higher dividends.

用用車子來做比喻,

ROE就是車子跑的速度,盈再率為耗油率。

我們選股兩大條件「高ROE、低盈再率」

就是要買跑得快而且省油的車子。

這是在講盈餘跟現金的概念,兩者是不一樣的概念。

Using a car as a metaphor, the ROE can be compared to the speed at which the car is traveling, and the PR% represents the fuel consumption rate. When choosing stocks, it's ideal to look for a combination of "high ROE and low PR%", similar to buying a car that runs fast and efficiently. This distinction highlights the difference between profit and cash, as they are not synonymous concepts.

力晶2008年大虧了575億元,

可是現金只少掉168億元,何故?

力晶是做什麼的?DRAM,

什麼東西很貴?設備很貴。

2008年金融風暴沒有生意可做就停工,員工放無薪假,

虧在哪裡?

機器設備的折舊,並未燒掉多少現金。

In 2008, Powerchip (5346.TW) suffered a loss of NT$57.5 billion, but only NT$16.8 billion in cash was lost. Powerchip is a DRAM company and its largest expense is on equipment. During the 2008 financial crisis, work was temporarily suspended due to a shortage of orders and employees took unpaid leave. The loss was primarily due to depreciation of machinery and equipment, which did not consume a large amount of cash.

虧損累累公司不會倒閉,現金周轉不靈才會,

台鐵幾十年來嚴重虧損,卻未倒閉。

只要從外面再弄錢進來,

跟股東要錢、向政府申請補助、或者賣土地,

就不會倒閉。

A company that experiences losses may not go bankrupt, but if it lacks sufficient cash flow, it can become insolvent. Taiwan Railway, despite its prolonged losses, continues to operate because it can obtain funds from outside sources through methods like raising capital from shareholders, receiving government subsidies, or disposing of land to replenish its cash reserves."

所以看一家公司要看兩個不同面向:

公司的價值在賺錢,錢賺越多越好,

衡量的指標看ROE,

盈餘 = 價值(ROE)

還要看現金周轉會不會有問題,

預警的指標是算盈再率,

現金 = 周轉(盈再率)

Therefore, evaluating a company requires considering two different perspectives:

The value of a company lies in its ability to earn profits, and the more money it makes, the better its value.

The measure used to assess this is ROE.

Profit = Value (ROE)

In addition, the evaluation also depends on the company's cash flow stability.

The key warning sign is the Profit Reinvestment Rate (PR%), which reflects the proportion of profit being reinvested.

Cash = Cash Flow (PR%)

現金要怎麼看?

資產負債表的第一個科目的就是現金,

不過它只表明公司現在手上有多少現金,

未說明現金是什麼進來怎麼進來,怎麼出去的?

現金如何進出對於區別公司好壞有很大不同,

若現金是自己賺來的是最好,

舉債來的就不好了,

賣土地來的也不太好。

要知道現金怎麼進出得去看第三張財務報表叫現金流量表。

How to evaluate cash?

The first item on the balance sheet is cash, which only indicates the amount of cash the company possesses. It doesn't provide information on the movement of cash, including incoming and outgoing. The distinction between strong and weak companies can greatly depend on the flow of cash. If the cash is generated internally, that is the optimal scenario. Borrowing money is not preferable, and selling assets, such as land, is also not ideal. To gain insight into cash inflows and outflows, you must review the third financial statement, the statement of cash flows.

它把所有的會計科目重新分類,分成三大類:

營業活動的產生的現金流量、

投資活動所產生的現金流量、

融資活動產生的現金流量。

最後期末現金等於資產的現金,

在解釋資產的現金怎麼進來,怎麼出去的。

It reclassifies all accounting accounts into three categories: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. The final ending cash balance is equal to the cash of assets, explaining the inflows and outflows of assets.

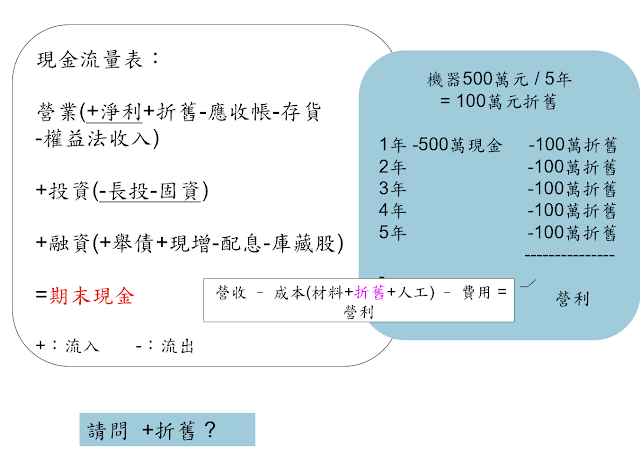

科目前面+表示這個科目的增加會造成現金流入,

-表示這個科目的增加會造成現金流出。

請問折舊為什麼是+呢?

折舊的增加為何造成現金流入?

A "+" in front of an account indicates that an increase in the account will result in cash inflows, while a "-" indicates that an increase in the account will result in cash outflows. Why is depreciation shown as "+"? Why does an increase in depreciation result in cash inflows ?

買一部機器500萬元,用5年,每年提列100萬元折舊。

這500萬元現金在買機器的第一年已經付掉了,

每年在算營業利益時又多扣掉100萬元折舊,

營收減掉成本,成本裡包含了折舊。

折舊沒付掉現金,可是在算營業利益裡被扣掉,

在算現金時要把它加回來。

A machine was purchased for $5 million and is expected to be used for 5 years, with an annual depreciation set at $1 million. In the first year of purchasing the machine, $5 million in cash was paid. When calculating operating profit, the $1 million annual depreciation is also deducted as part of expenses. Although no cash was actually paid for depreciation, it is deducted from operating profit, so it must be added back when calculating cash.

若仍不明其義,可以這樣想會比較簡單:

所謂營業活動所產生的現金流量等於每個月領的薪水,

投資活動即去買股票,

融資活動是借錢。

假設每個月薪水10萬元,

買股票12萬元,

借錢8萬元,

手上現金即6萬元,

這就是現金流量表!

If you still don't understand the meaning, it's easier to think of it this way:

Cash flow from operating activities is equal to the monthly salary received,

Investment activities include buying stocks,

Financing activities involve borrowing money.

Assuming a monthly salary of $100,000,

Buying stocks for $120,000,

Borrowing $80,000,

Cash on hand is $60,000.

This is the cash flow statement !

請問這個人會不會現金周轉不靈?不知道,

這就現金流量表的缺點,不曉得會不會周轉不靈?

我的盈再率就是在補足這個缺點,告訴大家答案。

盈再率的分子固定資產加長期投資增加的部分,

等於投資活動 -固資 -長投,

分母淨利和即營業活動中最重要的科目,

盈再率=投資活動÷營業活動。

本例買股票12萬元÷薪水10萬元=盈再率120%,

120%會不會周轉不靈?

還不會,因只差2萬元周轉一下就過來了。

盈再率100%指薪水10萬元,買了10萬元股票,剛剛好夠用。

Can this person have cash flow problems? It's unclear. This is the disadvantage of the cash flow statement, as it doesn't provide information on the sufficiency of cash flow. To address this limitation, I use the PR%. The numerator of the PR% is the increase in fixed assets and long-term investments (representing investment activities), and the denominator is net earnings, which is a crucial component of operating activities. The PR% is calculated as investment activities divided by operating activities. In this example, with a monthly salary of $10,000 and stocks purchased at a cost of $12,000, the PR% is 120%. This indicates that the cash flow is sufficient, as a $2,000 shortfall can easily be borrowed. An PR% of 100% means that the salary and stock purchases are equal, providing sufficient cash flow.

要差到多少才會危險?

薪水10萬元買20萬元股票才危險,

即盈再率200%,有2種可能性:

一是被嚴重掏空,

一是在大量投資的產業,

像DRAM、LCD,這兩個產業下場都很慘,

盈再率超過200%絕對不可以買。

How much difference is considered dangerous?

Having a 200% PR% by investing $200,000 in stocks with a monthly salary of $100,000 is considered dangerous.

There are two potential outcomes:

One is embezzlement,

the other is investing in an industry with aggressive expansion,

such as DRAM and LCD, which have both suffered significant losses.

Investing with a PR% exceeding 200% is not advisable.

所以要保持安全邊距,盈再率大於80%就不太愛買。

不太愛買就去Costco買,因可以秒退。

Therefore, it is essential to maintain a margin of safety. A PR% greater than 80% is considered too high, and it is not advisable to make the purchase.

盈再率只要低於80%以下就好,

沒有越低越好或負的就不好這回事。

因為周轉是不要超過那條界線,

在底下愛怎麼周轉都沒有關係,無所謂越低越好。

As long as the PR% is below 80%, it is fine,

there is no correlation between a lower PR% and being better, or a negative PR% being worse.

Cash flow should not exceed the established limit, regardless of how you manage your cash flow below that limit, it is not better or worse, there is no such thing as the lower the better in cash flow management.

公司虧損盈再率標為虧損。

盈再率為負則表示4年來沒有添加新的機器設備,

因為折舊價值越來越低。

If the company is loss-making, the PR% will be labeled as "LOSS".

A negative PR% means that no new equipment has been added in the last 4 years, and due to depreciation, the value of the machine is decreasing.

同學問我「盈再率負的有沒有關係?」

我說「盈再率小於80%就好。」

同學仍不解「那負的呢?」

我反問「負的有沒有小於80%?」

同學居然愣在那裡。

教這個班沒太多困難的問題可以回答,多半是國小數學。

Some students asked me: "Does it matter if PR% is negative?"

I replied: "As long as PR% is below 80%, it doesn't matter."

The students asked further: "What about negative PR%?"

I responded: "Is a negative number below 80%?"

The students were stunned and didn't know how to respond.

This course mainly covers basic arithmetic, with few challenging questions.

有一個李姓牙醫嗆我盈再率不對,

要改成他自創的公式:

(固資4+長投4-固資0-長投0) / (淨利4 - 淨利0)

A dentist with the surname Li scolded my PR% for being incorrect and demanded that I change it to his own formula: (Fixed Assets 4 + Long-term Investments 4 - Fixed Assets 0 - Long-term Investments 0) / (Net Profit 4 - Net Profit 0).

這條公式一看就知道錯了,

若淨利4 = 淨利0 時,分母為0,變成無限大,

牙醫竟然認為現金周轉將出大問題。

第4年和第0年賺一樣多,還是很賺啊,

怎麼財務會出問題?實在好笑。

I instantly recognized that his formula was incorrect. If net profit in year 4 is equal to net profit in year 0, then the denominator would be zero, resulting in infinity. Despite having the same profit in both years, Dentist Li feels that cash flow is a major problem for the company. It's absurd that a company that is still profitable could encounter financial difficulties.

分母 0 為無限大,這僅是國小數學,

這個仁兄居然不知,在他的部落格狂吠,

丟盡他自己的臉還不自知,

已經好幾年還死不認錯。

死不認錯乃建德修業之賊也!

A denominator of zero results in infinity, which is just a basic concept in elementary mathematics. It's astonishing that this person didn't know this and was ranting about it on his blog. He has lost face and yet refuses to acknowledge his mistake. It's been several years, but he still refuses to admit his error and apologize.

Refusing to admit one's mistakes is a sign of a lack of virtue and integrity.

金融股不適用盈再率,因為金融股沒有機器設備,

而且金融股的長期投資特別大。

一年以上的放款和買一年期上的公債都算是長期投資,

所以算出來的盈再率都高得嚇人,甚至上千。

Financial stocks do not apply PR% because they do not have assets such as machinery and equipment. Furthermore, long-term investments in financial stocks tend to be substantial, including loans with a term longer than one year and bonds with a maturity greater than one year. As a result, the calculated PR% can be very high, reaching thousands.

金融股改看配息率,大於40%才是配得出現金。

40%的標準是從講稿10/21講到的兩家地雷股

雅新跟SAY得到的結論,屆時再解釋。

Financial stocks take into account dividend payout ratios above 40%, indicating that a sufficient amount of cash has been paid out. This 40% requirement is derived from two problematic stocks, Yahsin (2418.TW) and SAY, discussed in Lecture 10/21, which will be explained further later.

講稿 1/21:歡迎 (Lecture 1/21 Welcome)- 講稿 2/21:知與不知 (Lecture 2/21 Knowable and unknowable)

- 講稿 3/21:巴六點 (Lecture 3/21 Buffett's Six Criteria)

- 講稿 4/21:物美價廉 (Lecture 4/21 Good quality and low price)

- 講稿 5/21:還原股價 (Lecture 5/21 Adjusted stock price)

- 講稿 6/21:高ROE (Lecture 6/21 High ROE)

- 講稿 7/21:配得出現金 (Lecture 7/21 High dividends)

- 講稿 8/21:會計 (Lecture 8/21 Accounting)

- 講稿 9/21:地雷股 (Lecture 9/21 Landmine stocks)

- 講稿 10/21:他們通通是錯的 (Lecture 10/21 They are all wrong)

- 講稿 11/21:不會變的公司 (Lecture 11/22 Durable)

- 講稿 12/21:多種果樹 (Lecture 12/21 Diversification)

- 講稿 13/21:IRR (Lecture 13/21 IRR)

- 講稿 14/21:殖利率陷阱 (Lecture 14/21 Yield trap)

- 講稿15/21:GDP理論 (Lecture 15/21 GDP Theory)

- 講稿 16/21:全世界都成立 (Lecture 16/21 Globally applicable)

- 講稿17/21:不要想太多 (Lecture 17/21 It's not that deep)

- 講稿 18/21:玩融資期貨選擇權是悲劇的開始 (Lecture 18/21 Margin trading, futures and options are the beginnings of a tragedy)

- 講稿 19/21:基金太貴,不做代操 (Lecture 19/21 Funds are too expensive, don’t manage other's funds)

- 講稿 20/21:股債不是蹺蹺板 (Lecture 20/21 Stock debt is not a seesaw)

- 講稿 21/21:技術分析真荒謬 (Lecture 21/21 Technical analysis is ridiculous)

沒有留言:

張貼留言

注意:只有此網誌的成員可以留言。