在進一步講解巴菲特理論之前要先提醒各位,

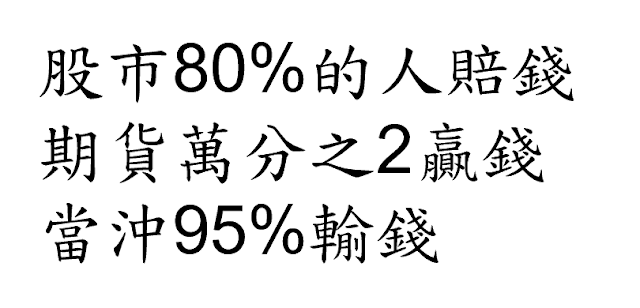

股票市場的風險非常大,80%的人賠錢!

這次儘管上了1萬點,可是賺到錢的人仍然不多,

因為多半漲在台積電、大立光,散戶不會買的股票。

Before discussing Buffett's theory, it's crucial to keep in mind that the stock market is associated with significant risks, with the majority of investors (80%) incurring losses. Despite the index reaching 10,000 points recently, only a few investors benefited as the majority of gains were focused in TSMC (2330.TW) and Largan (3008.TW), which are not widely held by retail investors.

這是股票,玩期貨、選擇權又是多少人賺錢?

今周刋訪問台灣期貨之神黃毅雄,

他說「玩期貨1萬人僅2人贏錢!」,

其意即沒有人能賺到錢。

黃桑雖貴為期貨之神,但一生中破產過8次,

想必這輩子過得很痛若。

一位期貨營業員曾跟我說,

他的客戶大概每3個月就會陣亡一批,

他主要工作是在開發新客戶。

一聽很令我錯愕,仔細思量,但是又何奈!

This is regarding equity investment. How many investors make a profit through futures and options trading?

The cover story of Business Today magazine features Taiwanese futures expert Yisiong Huang.

According to Huang, only 2 out of 100 players make money when trading futures.

This highlights the difficulty and risk involved in futures trading.

Interestingly, despite being a futures expert, Huang has declared bankruptcy 8 times in his life.

A futures broker once revealed to me that some of his clients lose all their money every three months.

His main responsibility is to acquire new clients.

This information was surprising and highlights the reality of the volatile nature of futures trading.

曾問過營業員玩當沖的多少人賺錢?

當沖即當日沖銷,當天先買後賣,或先賣再買,

看今天是開高走低或開低走高,

2種狀況猜對其一就會賺錢,機率應是1/2,

可是營業員說「玩當沖的人95%輸錢。」

我還回他「不錯啊!至少還有5%的人賺錢,」

營業員卻答「可是那5%的人每次都是不一樣的人。」

I once asked a broker about the success rate of day traders. Day trading involves buying and selling securities within the same day, or selling first and then buying. If a trader accurately predicts market trends, they can make a profit. Theoretically, the chance of success is 50%. The broker informed me that, unfortunately, 95% of day traders incur losses. I responded optimistically, "At least 5% of traders make money," but the broker retorted, "Those 5% of profitable traders change every time." This emphasizes the volatile and ever-changing nature of day trading and the difficulties associated with it.

這就是股市殘酷的事實,80%的人賠錢!

很多人一定奇怪,股票不是漲跟跌而已嗎,

用猜的機率該是1/2?

不是1/2,因為要猜2次,

買和賣都猜對才會賺錢,機率1/4。

This is the bitter truth about the stock market: 80% of investors fail to make a profit. Some investors might be surprised by this statistic, as they may have thought that stock prices only fluctuate, providing them with a 50-50 chance of making a successful investment. However, the reality is that one must accurately predict both the right time to purchase and the right time to sell, which decreases the probability of success to only 25%.

1/4接近25%,這就是股市80%的人賠錢的原因,

因為大部分人在玩猜的遊戲。

說大家在猜,一定有人不服氣,

投資人每天都很用功啊,

一大早起來要先看美股收盤收得怎麼樣,

然後再看工商、經濟各大財經報紙和雜誌,

甚至周六日都來上課,怎麼會說在猜呢?

因為大家花時間在研究一些不可知的問題,

不可能知道答案的問題。

The likelihood of success in the stock market is approximately 25%, which is why a majority of players, 80%, lose money. This statement that investing in the stock market is simply a matter of guesswork may be disputed by some. Many investors put in substantial effort, such as rising early to follow the close of the US market, reading well-known financial publications like the Commercial Times and Economics Daily, and even attending classes on weekends. However, the fact remains that they are analyzing uncertain variables and making predictions about unknowable events, making it plausible to argue that stock market investing is essentially a guessing game.

投資人都在研究什麼?

第一、都在問下個禮拜什麼股票最會漲?在找明牌,

這也是今天大家來上課最主要目的,看麥可報什麼明牌。

問題是誰知道呢?若有人認為可知,

請現在就把答案寫下來,等到下周五收盤後再核對看看,

保證一定猜錯。這是一個不可知的問題。

What are investors researching? They are interested in finding out which stocks will likely have the largest gains in the coming week and are seeking stock tips. The primary objective for everyone in the classroom is to seek advice from Michael. Who has the answer? If anyone thinks they know, please write down their response and check it after the end of next Friday. However, keep in mind that this is an unknowable issue, and it is possible that your guess will be incorrect.

第二、大家會看公司的獲利預估,今年、明年賺多少錢?

因為股價反應基本面。

公司的盈餘預估是分析師估的,

我以前就是外資電子股分析師,常常在拜訪公司,

問公司現在產能利用率如何?產品毛利是多少?

成本結構又怎樣?未來擴產計劃?

根據公司的回答估出獲利。

Secondly, everyone is examining the company's projections for its profits this year and next year, as stock prices reflect fundamental factors. The company's profit forecasts are made by analysts. I used to work as a foreign electronics analyst, frequently visiting companies and inquiring about their current capacity utilization rate, product gross margins, cost structure, and future expansion plans. I would then make profit projections based on the company's responses.

歐美基金經理人會要求預估未來3年,

日本則要未來5年,越長越好估。

一個日本經理人問我飛瑞電子未來5年盈餘預估,

我花不到5分鐘就估出來,本來當天要傳真給他,

覺得太快,隔一天才傳,

還在電話上跟他說「昨天特別加班幫你估這個數字。」

反正他亂問我就亂估,

問未來5年飛瑞電子獲利會如何?

我連自己未來5年人在什麼地方都不知?

European and American fund managers require profit projections for the next three years, while Japanese managers require forecasts for five years. The longer the forecast period, the easier it is to estimate. A Japanese manager once approached me for a five-year earnings forecast for Phoenix Electronics (2411.TW). I finished the estimate in under five minutes and initially planned to send it by fax on the same day, but decided it was too early and sent it the next day. I informed the manager over the phone that I had worked overtime the previous day to complete the estimate. Quick checks only produce rough estimates. How can one predict Phoenix Electronics's profits in the next five years? I don't even know where I'll be in the next five years.

當分析師時常常在事後把預估拿來驗證看看,

發現誤差都很大,不是30-40%的問題,而是方向,

我都估成長,其實多半衰退。

有人說分析師估不準是因為外部人,公司沒透露實情,

公司內部人知道什麼狀況?

即便公司老闆能夠掌握的也頂多未來3到6個月的出貨狀況,

客戶下單都是到前3個月才確認數量,

若當時市況不好後面的訂單就砍掉了。

可是我們都在看未來3年的獲利,瞎掰居多!

As an analyst, I frequently look back at past predictions. I have discovered that the error rate is substantial, not only in terms of magnitude (30-40%) but also in direction. I often predict growth, but it frequently turns out to be a decline. Some people attribute the lack of accuracy in predictions to the fact that analysts are outsiders and companies do not disclose all the relevant information. But what do the company insiders know? Even the CEO can only control deliveries up to the next 3 to 6 months. Customer orders are confirmed three months before they are placed, and if market conditions are unfavorable, orders can be cancelled. Despite this, we still focus on predicting profits for the next three years, often relying on conjecture.

當分析師時最喜歡問公司訂單能見度可以看未來幾個月?

如今自己開了這個班才發現這是一個非常好笑的問題。

若問我巴菲特班訂單能見度能看未來幾個月?

只能說這個月的招生狀況是好還是不好我大概可以猜得出來,

可是下個月以後就全然不知,因還零星在報名。

甚至問今天到底會有多少人來上課?

到現在都還搞不清楚,

不過比較好的是10:00再來清點人數就好,

因10:00才要叫便當,沒有存貨的問題。

As a researcher, I used to inquire about the visibility of orders for the company for the next few months. Now that I run my own class, I find it a funny question to ask. When asked about the visibility of orders for the Buffett class, I can only estimate the current month's enrollment status as good or not. Beyond that, I have no idea as enrollment is unpredictable. Even estimating the number of attendees for today's class remains uncertain. However, I need to conduct a headcount only at 10:00, as this is the time when lunch orders must be placed and there should be no concerns regarding inventory.

第三、投資人還會問股價多少錢可以買?將漲到多少錢?

這才是大家最想問的問題。

Third, investors frequently inquire about the purchase price and the expected stock appreciation. This is the most popular question among investors.

這幾年外資在看宏達電的股價,

2010年跌到300元時公司出來喊

「要展開機海戰略,不惜犧牲毛利率來搶市場占有率。」

一聽要犧牲毛利率,外資都在喊賣,後來股價漲到1,300元,

外資改口上看1,500,後來卻跌到40元。

顯見股價漲到多少連外資也看不清楚,

這是一個不可知的問題。

In recent years, foreign investors have been observing the stock price of HTC (2498.TW). In 2010, when the stock price fell to NT$300, the company announced, "We will launch an aggressive strategy to seize market share, even at the cost of sacrificing gross profit margin." Upon hearing about the sacrifice of gross profit margin, foreign investors started selling, but later the stock price rose to NT$1,300. Foreign investors revised their target price to NT$1,500, but later it fell to NT$40. It's evident that even foreign institutional investors don't have a clear understanding of where the stock price will go, making this an unknowable issue.

第四、大家會問大盤將漲到幾點?

尤其現在1萬多點了更是關心。

2016年6月英國脫歐,赫赫有名的大師都看得很空,

索羅斯喊「金融海嘯2.0來了!」

羅傑斯說「未來一兩年不會買股票」,

葛林斯潘「英國脫歐比1987年道瓊暴跌還糟」,

後來指數硬是創了新高,大師們全部摃龜,

由此可知這也是個不可知的問題。

Fourthly, individuals are curious about the extent of market growth, particularly given the market's current level of over 10,000 points. In June 2016, during the UK's vote to leave the EU, prominent experts held pessimistic views. Soros proclaimed "Financial crisis 2.0 is arriving!" while Rogers said "I won't be buying stocks in the next one or two years," and Greenspan stated "Brexit is even worse than the 1987 Dow Jones crash." Despite these predictions, the market defied expectations and hit new highs, causing these experts to be humbled. This emphasizes that the market's future is an unknowable matter.

什麼是可知?什麼是不可知?

股價的漲跌不可知,貴淑卻是可以算,

按盈再表就可得出股價貴或便宜。

只要在股價便宜時買,貴了賣掉,便宜買,貴了賣,

這樣一直做、反覆做,即能賺到大錢。

如此就不是在玩猜的遊戲,

因都是根據可知的事實在做決策,

賺錢的機率將大大提升。

"What is knowable and what is unknowable? The fluctuation of stock prices is uncertain, but it can be assessed if a stock is cheap or expensive. Michael On's table calculates the fair value for each stock. By buying when stocks are underpriced and selling when they are overpriced, and repeating this strategy, one can enhance their wealth. This minimizes the reliance on guesswork as decisions are made based on verifiable data, thereby increasing the odds of making profits.

香港李嘉誠從2013年開始大量抛售中國的房地產,

轉去投資歐洲,買下許多英國公司。

這幾年中國房地產漲得老高,歐洲基礎產業卻很便宜。

甚至李超人的成份股香港電燈,香港電力公司,股價貴了,

一樣是把它分拆出去,然後把股權賣掉一半。

Li Ka-shing, a prominent figure in Hong Kong, started selling off his Chinese real estate in 2013 and redirected his attention towards European investments, acquiring multiple firms in the UK. In recent years, real estate prices in China have skyrocketed while infrastructure in Europe still remains relatively cheap. Even Superman Li's core holding companies Hong Kong Electric (0006.HK), a Power Company, are expensive.

He split it up and sold half of his shares.

李嘉誠在幹嘛呢?就在賣貴的,去買便宜,

可是一般人卻是只要股價繼續漲,就不認為它貴,

這是贏家跟輸家的差別!

What Mr. Li is doing is just the basic strategy of buying cheap and selling expensive. As long as the stock price continues to rise, many investors consider it not overpriced. This distinguishes successful investors from unsuccessful ones.

「股價漲跌不可知」是世界上最難以了解的一句話,

第一堂課就特別強調,

可是上完課之後同學仍一直在問股價,

甚至拐彎抹角在問。

同學最喜歡問我「這支股票現在可以買嗎?」

正是在問這支股票買了之後會不會馬上漲?

因若買了之後下跌,就不是現在可以買。

我訓了他一頓「股價漲跌不可知,貴淑才可知」,

同學馬上問「夠便宜了嗎?」

仍然在問股價漲跌。

"The rise and fall of stock prices cannot be known" is one of the most difficult concepts in the world to grasp. Despite this emphasis in the first class, students kept asking about stock prices, even through indirect means. The question they are most concerned about is "Can I buy this stock now?" they are asking about the stock's immediate rise after purchase. If the stock price falls after buying, it is no longer a good time to buy. I tried to explain to them, "The rise and fall of the stock price is unknowable, but we can calculate whether a stock is cheap or expensive." However, the students quickly followed suit: "Is it cheap enough?" It shows that they are concerned about the rise and fall of stock prices.

講稿 1/21:歡迎 (Lecture 1/21 Welcome)- 講稿 2/21:知與不知 (Lecture 2/21 Knowable and unknowable)

- 講稿 3/21:巴六點 (Lecture 3/21 Buffett's Six Criteria)

- 講稿 4/21:物美價廉 (Lecture 4/21 Good quality and low price)

- 講稿 5/21:還原股價 (Lecture 5/21 Adjusted stock price)

- 講稿 6/21:高ROE (Lecture 6/21 High ROE)

- 講稿 7/21:配得出現金 (Lecture 7/21 High dividends)

- 講稿 8/21:會計 (Lecture 8/21 Accounting)

- 講稿 9/21:地雷股 (Lecture 9/21 Landmine stocks)

- 講稿 10/21:他們通通是錯的 (Lecture 10/21 They are all wrong)

- 講稿 11/21:不會變的公司 (Lecture 11/22 Durable)

- 講稿 12/21:多種果樹 (Lecture 12/21 Diversification)

- 講稿 13/21:IRR (Lecture 13/21 IRR)

- 講稿 14/21:殖利率陷阱 (Lecture 14/21 Yield trap)

- 講稿15/21:GDP理論 (Lecture 15/21 GDP Theory)

- 講稿 16/21:全世界都成立 (Lecture 16/21 Globally applicable)

- 講稿17/21:不要想太多 (Lecture 17/21 It's not that deep)

- 講稿 18/21:玩融資期貨選擇權是悲劇的開始 (Lecture 18/21 Margin trading, futures and options are the beginnings of a tragedy)

- 講稿 19/21:基金太貴,不做代操 (Lecture 19/21 Funds are too expensive, don’t manage other's funds)

- 講稿 20/21:股債不是蹺蹺板 (Lecture 20/21 Stock debt is not a seesaw)

- 講稿 21/21:技術分析真荒謬 (Lecture 21/21 Technical analysis is ridiculous)

沒有留言:

張貼留言

注意:只有此網誌的成員可以留言。