關於理財,很多人買基金,

因一般人沒有理財知識想找個專家。

我反對買基金,因為基金太貴了,

基金手續費加管理費一年約2-3%,

看起來不多,其實非常貴。

When it comes to financial management, a lot of people opt to buy funds due to their lack of knowledge and desire to seek out an expert. However, I disagree with this approach as I find funds to be overly expensive. The combination of fund handling fees and management fees amount to approximately 2-3% per year, which may seem negligible, but it actually adds up to a substantial cost.

更有錢的人可以代操,

代操抽獲利的15%為佣金,

若獲利20%,代操的費用也是3%(=15%x20%)。

Wealthier individuals can opt for fund management services, where the management fee is 15% of the profits earned. For instance, if the profits earned are 20%, the cost of fund management would also be 3% (=15%x20%).

基金和代操都抽3%,看似一樣其實不然,

基金無論賺賠都要抽,

代操則是有獲利才能抽,

基金比代操貴 1 倍。

Both funds and proprietary funds charge a 3% fee, which may appear to be identical, but in fact they differ in their fee structures. Funds levy a fee irrespective of whether there is a profit or loss, while proprietary funds only charge a fee when there is a profit. Consequently, funds are twice as expensive as proprietary funds.

上述假定獲利20%是股神巴菲特才有的績效,

祂還有浮存金,

你的基金經理人是巴菲特嗎?

你有浮存金嗎?

比較務實的估算,獲利應抓10%,

這樣基金又比代操貴 1 倍。

The earlier assumption of a 20% profit only pertains to the investment performance of stock market guru, Warren Buffett, who has a float. Therefore, the pertinent questions to ask are: Is your fund manager as skilled as Buffett? And, does your investment have a float? A more pragmatic estimate would be to reduce the expected profit by 10%. Using this estimate, it can be concluded that funds are twice as expensive as proprietary funds.

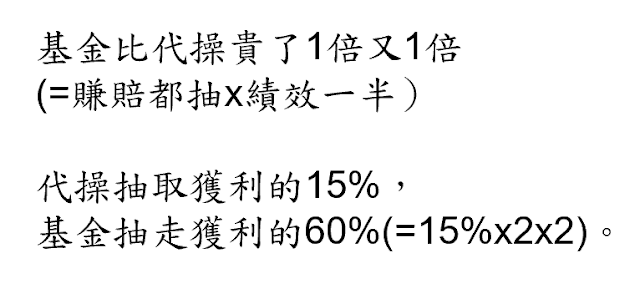

基金比代操貴了 1 倍又 1 倍,

代操抽取獲利的15%,

基金抽走獲利的60% (=15%x2x2)。

Funds are four times as expensive as proprietary funds. Proprietary funds charge a management fee of 15% of the profits earned, while funds charge 60% of the profits earned (calculated as 15% x 2 x 2).

2016年報老巴解釋為何多數基金無法打敗大盤,

因為收費太貴,

祂算出投資獲利的6成都被投信抽走了,

6成的結論和我之前算的結果一樣,

In his 2016 annual report, Warren Buffett explained why most funds fail to outperform the market. The reason is that their fees are too high. He calculated that 60% of investment profits are taken by fund companies, and this conclusion aligns with the results I previously calculated.

賠錢時賠客戶的,賺了錢要分6成,這跟土匪何異?

同學跟我投訴,她買香港的什麼基金管理費抽5%。

我當場催促她「趕快去報案!」

同學還說「基金要綁約20年。」

我訝然「是保證獲利的基金嘛?」

她苦笑「哪有保證?5元多港幣買進,現剩2元多。」

建議她贖回,她的理專似笑非笑地說

「請用現在價格打8折賣賣看,看有沒有人接?」

贖回不是用淨值,是打8折,

打8折還不保證賣掉,

這樣不等於全給它了嗎?

When losing money, the clients bear the loss, but when making money, 60% is taken away. Isn't this no different from bandits? A student complained to me that she was charged a 5% management fee for a fund she bought in Hong Kong. I urged her on the spot, "Report the crime quickly!" The student also mentioned, "The fund is tied up for 20 years." I was surprised and asked, "Is it a guaranteed profit fund?" She smiled bitterly and replied, "How can there be a guarantee? I bought it for over HK$5, and now there's only over HK$2 left." I suggested that she redeem the fund, but her financial advisor smiled and said, "Try selling it at a 20% discount on the current price and see if anyone will take it." The redemption is at an 80% price, not the net asset value, and even with an 80% discount, there is no guarantee of sale. Isn't this like giving everything away?

台南同學也跟我反映他買什麼基金也綁約20年,

績效很爛,建議他贖回,

理專板起臉說:「要贖回是嘛...

請先把未來20年管理費一併付清。」

他嚇了一跳,

管理費一年2%,20年一併付清不就要40%。

我笑他買的是伊斯蘭國發的基金,一贖回就腰斬。

A student from Tainan shared with me that he had invested in a fund that had a lock-in period of around 20 years with very poor performance. I advised him to redeem it, but the financial adviser's response was unpleasant. He said, "If you want to redeem, you need to pay the management fee for the next 20 years in advance." This caught the student off guard. The management fee was 2% per year, which means he would have to pay 40% for the next 20 years. I jokingly teased him that he might have invested in a fund issued by the Islamic State and halved it immediately after redemption.

有人說,不會理財找專家幫忙,

賺了錢給人多分一點,也無所謂!

問題是這個專家只幫忙做簡單的事,

困難的工作仍留給你自己。

Some people say that they don't know how to manage their finances, so they seek help from experts. It doesn't matter if the experts make more money and receive more bonuses! The problem is that these experts can only help with simple tasks, and the difficult work is still left for you to handle on your own.

投資只在做2件事,選股跟買賣時機,

即高ROE,淑買貴賣。

這2件事哪一點比較簡單?

當然選股簡單,不會選龍頭股買一買就對了。

買賣點比較難判斷,

1 萬點減碼後,請問何時再買進?

There are only two things to consider in investment: stock selection and trading timing, meaning higher ROE and good buying and selling prices. Which of these two is simpler? Of course, stock selection is simpler. If you don't know which stock to buy, choose leading stocks. Buying and selling, on the other hand, is more difficult to judge. When the position reaches 10,000 points, we cut it. When can we buy it back?

抽管理費還算客氣,理專要賺錢最好賺的其實是洗錢,

洗客戶的錢。

It is polite to charge management fees, the easiest way for financial advisors to make money is money laundering, which means laundering customers' money.

現在美股當紅,建議來買美股,

先叫客戶把台幣換成美金,買美元保單,

又說歐元便宜換成歐元,

南非幣利率高再換,

高收益債在漲又追,

等跌下來才買美股基金。

每次轉換就抽一次手續費,洗客戶的錢最好賺。

若買的基金才賺5%,

理專就打電話來叫你轉換就是在洗你的錢。

U.S. stocks are gaining popularity among investors, with advisers recommending purchasing them. To do so, they first require customers to convert their Taiwan dollars into U.S. dollars and purchase U.S. dollar insurance policies. They also suggest exchanging currency into the euro, which they say is currently very cheap, and the South African currency, which has high-interest rates and is profitable to change into. Advisers are pushing for high-yield bonds, which are on the rise and should be chased after quickly. They also suggest waiting for a drop in the market before purchasing U.S. equity funds. Each conversion comes with a handling fee, and advisers often make money through laundering customers' funds. If your financial advisor asks you to transfer to other funds after only a 5% return, they may be laundering your money.

我們會在投資組合中加入15%ETF

為了解決一個問題

2024年高點需要減碼時我的持股都還便宜

以致不知從何下手只好平均賣20%

100多檔股票平均賣20%是件大工程

所以在持股中加入15%的指數型ETF

以便在高點緊急賣股時直接砍掉ETF

搭配貴了和不喜歡的持股

即可湊足最多賣1/3的原則

We plan to allocate 15% of the investment portfolio to index ETFs to address a specific issue.

In 2024, when the market reached a high and it was time to reduce exposure, many of my individual stocks were still undervalued.

Not knowing where to begin, I ended up selling 20% of all my holdings across the board.

With over 100 stocks, that was a massive undertaking.

By allocating 15% of the portfolio to index ETFs, I can quickly offload them during market peaks to reduce risk. This can be combined with trimming overpriced or less favored stocks to stay within the guideline of selling up to one-third of the portfolio.

ETF的交易只會在GDP高低點為之

不會採定期定額因為績效會少27% (參見本章下文)

We will only trade ETFs at GDP peaks and troughs.

We do not follow a dollar-cost averaging strategy, as it would reduce overall performance by 27% (see later in this chapter).

只買指數型ETF的原因是

在股市未跌下來之前

投資人一直吵著高股息ETF績效不如指數型

跌下來了才發現高股息ETF打敗大盤

我們在GDP高點就會把ETF賣掉

所以選擇指數型ETF

Our preference for index ETFs is based on the following:

Before a market downturn, investors often criticize high-dividend ETFs for underperforming index ETFs.

However, once the market declines, they realize that high-dividend ETFs can actually outperform the broader market.

Since our strategy involves selling ETFs at GDP highs, index ETFs are our preferred choice.

除此之外市場上充斥著對ETF錯誤的看法:

基金太貴,有人即鼓吹買收費較低廉的ETF指數型基金,

加上市場上多數人無法打敗大盤,

所以有人就選擇買ETF,績效跟大盤差不多就好。

Apart from that, there are widespread misconceptions about ETFs in the market:

Some people advocate buying low-cost ETF index funds because traditional mutual funds are too expensive. Plus, most people cannot beat the market, so they choose to buy ETFs with similar performance to the market.

上述觀點是錯的

1. 多數人無法打敗大盤?

這種說法存在一個陷阱。

與指數比較績效時是假設指數在起點全買入、終點全賣出。

當市場上漲時,指數因全買在低點而占盡地利,

讓選股者難以超越,

這是不公平的比較。

The above viewpoint is flawed.

1. Can most people not outperform the market ?

This claim is misleading.

Performance comparisons with an index assume the index is fully bought at its starting point and fully sold at its endpoint.

In a rising market, the index benefits from the assumption of being entirely purchased at the lowest point, creating an unfair advantage that makes it challenging for stock pickers to outperform.

This comparison is biased and unrealistic.

反之,當市場下跌時,指數因全買在高點而失去先機,

選股者只需適時減碼,即可輕鬆超越指數。

然而,績效比較多集中於上漲階段,卻很少討論下跌階段,

因此才產生「無法打敗大盤」的錯誤認知。

Conversely, when the market declines, the index loses its advantage due to the assumption of being fully purchased at the highest point.

Stock pickers can easily outperform the index by strategically reducing their positions at the right time.

However, performance comparisons often focus primarily on market uptrends and rarely address downturns, which fosters the false belief that outperforming the market is impossible.

為何巴菲特方法以壓倒性優勢擊敗市場和ETF?

因為指數和ETF成分股有一半是爛的貴的。

這些爛股若一支一支攤開來,投資人必不屑一顧,

可是包進ETF裡卻買單了,

蒼蠅不能吃,包進包子裡怎麼就覺得好吃了呢?

Why does Buffett's approach outperform the market and ETFs by a significant margin? This is because almost half of the components in the index and ETFs are either overvalued or inferior. If these individual stocks were evaluated on their own, investors would likely dismiss them. So why are investors willing to buy them when they are packaged into an ETF? It's like how flies are not edible, yet when they are wrapped in buns, they do not magically become delicious.

ETF踩到地雷股時還會拿不掉,

0050裡包含了宏達電,

股價從1,300元跌到40元不就是地雷股嗎?

拿不掉啊!

ETFs are unable to get rid of landmine stocks once they have invested in them. For example, HTC was included in 0050 and its stock price plummeted from NT$1,300 to NT$40, just like a landmine stock. Unfortunately, it is not possible to reduce its position to cut losses.

投資最好的方法是自己去組一個ETF,

選股很簡單,上完這堂課每個人都會挑股,

自己挑最好的公司,便宜時買,抱到貴才賣,

這樣績效會最好,明星高中考上台大的比例最高。

我的二本書「魔法書」和「神功」

後面附的入圍名單都遠遠打敗大盤好幾倍,

即最好證明。

我的二本書分別是2004年和2008年出的書,

指數約5,000,至今台股指數1萬點,

把股息加回去,指數約漲了1.5倍,

可是書後的入圍名單大統益、中碳、台塑、

和泰車、台積電、豐泰、巨大、美利達、

裕融、茂順,檔檔都大漲好幾倍。

Creating a personal ETF is the best way to invest. Picking quality stocks is relatively simple, and after attending my class, everyone will be able to select them. The strategy is to choose the best company, buy when it's cheap, and sell when it's pricey. This approach will provide the best performance. In my books, "Magic Book" and "Magic Skills," I have included a shortlist of stocks that I personally selected, all of which have significantly outperformed the market. This is the best evidence I can offer. The books and the lists were published in 2004 and 2008 when the Taiwan index was at about 5,000. As of now, it has reached 10,000 points, and with the inclusion of dividends, the index has risen by about 1.5 times. The appended shortlists include stocks such as TTET Union, China Steel Chemical, Formosa Plastics, Hotai Motor, TSMC, Feng Tay, Giant, Merida, Yulon Finance, and Nak Sealing Technologies. All these companies have doubled or more in value several times.

還有一個很多人的思考誤區和理專的話術,

說選個股會賠錢,買ETF不會

哪有這麼好的事!

讓你賠錢的股票在ETF裡頭一樣賠錢

不會變賺錢

There is another common misconception—and a sales pitch often used by financial advisors—that selecting individual stocks will make you lose money, while buying ETFs will not.

How could anything be that good?

A stock that loses money will still lose money even when it’s included in an ETF.

It doesn’t suddenly become profitable.

問題的癥結在於選錯股的機率很高30%

買錯ETF的機率一樣很高

一堆人買了投信力推的高股息ETF

現在績效很難看

The core problem is that the probability of picking the wrong stock is high—around 30%.

But the probability of buying the wrong ETF is just as high.

Many people bought high-dividend ETFs aggressively promoted by fund companies,

and their performance now looks quite poor.

而且嫌挑選麻煩,

很多人會將所有資產全押在1-2檔ETF上

2025年若重押在高股息,現在欲哭無淚無可挽回

相對的我們買100支股票,買錯了10幾支

績效仍然大幅打敗指數

Moreover, many people find the selection process too much of a hassle, so they end up concentrating all their assets in just one or two ETFs. If someone went all-in on high-dividend ETFs in 2025, they would now be full of regret, with no way to reverse the losses.

By contrast, we invest in 100 stocks. Even if more than a dozen of them turn out to be wrong picks, our overall performance can still significantly outperform the index.

結果現在回過頭來檢討幾支賠錢的持股,

原因竟然是沒買ETF

全然搞錯方向

Yet now, when people look back and review a few losing positions,

the conclusion turns out to be that the mistake was “not buying ETFs”— which is completely the wrong takeaway.

買ETF困難之處在於很難選擇

買個股按盈再表即可

選ETF呢?

美股ETF家數比個股還多

前50大、高股息、公司治理、高成長、價值型,...

要買哪一檔?

The difficulty with buying ETFs is that they are hard to choose.

With individual stocks, you can simply look at the On's table.

But how do you choose an ETF?

There are more ETFs in the U.S. market than individual stocks.

Top 50, high dividend, corporate governance, high growth, value style…

Which one are you supposed to buy?

無法直接挑選個股,才勉強去買ETF,

例如看好越南股市卻無法直接選股,

才退而求其次去買越南ETF。

The primary reason for purchasing ETFs is when one is unable to invest directly in individual stocks. For instance, if we are optimistic about the Vietnamese stock market but, for some reason, cannot invest directly in stocks, then we can consider investing in a Vietnamese ETF.

有人說,巴菲特也主張買ETF

老巴的原文是說 “average person cannot pick stocks”

不懂選股的一般人去買ETF。

令人訝異的是自詡為投資專家也在推廣ETF,

這不就承認專家自己不會選股 ?!

不會選股算什麼投資專家?

Some people claim that Buffett also recommends buying ETFs. However, Mr. Buffett's original statement was that the "average person cannot pick stocks." As a result, people who lack stock-picking skills opt for ETFs. Interestingly, even self-proclaimed investment experts promote ETFs, which raises the question of whether these experts can pick stocks themselves. After all, how can you call yourself an investment expert if you cannot pick stocks?

我不贊成買基金,更反對做代操。

同學千萬別以為上完課之後巴菲特神功就練成了,

準備下山去行走江湖幫親朋好友代操起來,

千萬別這麼做!

不管績效多好,好到跟巴菲特一樣,是巴菲特「再世」,

啊!拍謝,巴菲特仍「在世」,

是老巴的孌生兄弟姊妹,也不要做代操。

代操只要一個波段沒跑掉賠20%,客戶即翻臉離開,

這是人性,人家那麼一大筆錢給你玩,

賠了20%,當然會翻臉。

代操錯在違反人性。

I do not recommend purchasing funds, and I am even more against managing proprietary funds. Just because you have learned some of Buffett's investment techniques does not mean you should start helping friends and family with their financial management. It's a bad idea. Even if you have a strong investment performance and are as skilled as Buffett, you should not manage proprietary funds. If you lose 20% in a trade, customers will leave. It's just human nature. People give you a lot of money to invest, and a 20% loss will make them angry. Proprietary funds are a flawed business model because they go against human nature.

不要以為學了巴菲特神功之後就不會賠20%,

更會!

因為以前會跑,現在不會了。

還沒買股前跟客戶說你是巴菲特他絕對聽得進去,

買了股票賠了20%說你是巴菲特,

客戶就給你巴下去。

Don't assume that you won't experience a 20% loss even after learning Buffett's magic skills. It's even more likely to happen. During stock market declines, the buy-and-hold strategy is more likely to lead to a 20% loss compared to short-term trades with reduced losses. It's easy to tell customers that you're a skilled investor like Buffett, and they may listen to you initially. However, if you do end up losing 20%, claiming to be like Buffett won't help, as customers will be disappointed and may let you go.

翻臉離開的還是好客戶,

最怕的是翻臉不離開的,

晚上還叫你去八里媽媽嘴,才是可怕的客戶。

The customers who turn away are still good, but the ones who turn their faces and do not leave are the most frightening. If a customer invites you to a coffee shop in a remote area late at night, that's a terrible customer.

最好的方法就是來上巴菲特班。

上了2天的課同學應能感覺出這個方法很簡單,

只在按盈再表而已,任何人都學得會。

If you are looking for an alternative to buying funds or proprietary funds for financial management, I suggest taking my course. After just two days in the class, students should find this method very simple. You can learn by checking On's table, and anyone can do it.

而且不管什麼時候來上課我都可保護到同學,

我需要保護同學,因為只有同學用我的方法賺了大錢,

才會介紹親友好友來上課。

我的利益和同學是一致的,

理專、營業員、投信的利益和客戶不一定相同。

所以理財最好的方式是來上巴菲特班,財自己理就好,

以上是巴菲特班的置入行銷,打打廣告。

Regardless of when you enroll in my course, I will ensure your protection. I am dedicated to safeguarding my students because their success using my methods translates into referrals of their friends and family to my course. My interests are fully aligned with those of my students. The interests of bank financial advisers, securities company brokers, and fund companies may not align with their clients. Therefore, the best approach to managing your finances is to enroll in my course and take control of your investments. The above statements are part of my course promotion and advertising strategy.

買基金好還是ETF ?

當然是ETF。

買ETF好還是波克夏股票 ?

當然是波克夏。

買波克夏股票好還是上巴菲特班 ?

當然是上巴菲特班最好,才有「有為者亦若是」的快感。

巴菲特方法很簡單,人人都學得會。

Which is a better investment option: funds or ETFs?

ETFs are the better option.

What about ETFs or buying Berkshire stock?

Definitely buying Berkshire stock.

Is it better to buy Berkshire shares or attend the Buffett class?

It's best to attend the Buffett class and experience the thrill of "I am Buffett too". Buffett's investment strategy is simple and can be learned by anyone.

每回股市一到高點即會接到同學的諮詢電話,

說他的人生要重新開始,想找我諮詢。

我眼睛睜著大大地「我才收你6,000元,要教你巴菲特,

還要幫你的人生做規劃,這麼大的題目...」

Whenever the stock market reaches its peak, my students start consulting me. They tell me that their life is about to change and they need my advice. I widened my eyes and exclaimed, "I only charge you NT$6,000 to teach you about Buffett, and on top of that, I also have to help plan your life. It's such a huge undertaking..."

問他要幹嘛?同學答「想當專業投業人」,

我好納悶,這位同學我認識啊,

2005年來上課,北捷員工,

偶然在捷運站相遇,看到我沒事晃來晃去,心中不爽。

他說他也賺到錢了「賺到30年薪水。」

也想來當專業投資人。

同學績效當然很好,可是不像我接受過嚴格的分析師訓練,

在我看來仍是外行人,怎地想當「專業」投資人?

I asked him what he wanted to do and he answered, "I want to become a full-time investor." I was quite confused as I knew this person. He was a Taipei Metro employee who had attended my course since 2005. I happened to run into him by chance at the MRT station, and he seemed very disheartened to see me joking around. He told me that he had earned "30 years of salary" and wanted to become a professional investor like me. While the student's performance was impressive, he lacked the rigorous analyst training that I had received. From my perspective, he was still a layman. Did he really want to become a "full-time" investor?

問他要幹嘛?同學說「想把工作辭掉!」,

才會意「喔!把工作辭掉,那叫無業投資人。」

同學,把名詞定義清楚,答案才會正確。

Ask him what he wants to do? The student replied, "I want to quit my job!" and it dawned on me, "Oh! So he wants to be an unemployed investor." Clearly defining the terms will lead to the right answer for the students.

問他的專業在哪裡?

他說他的專業就是按盈再表!

「盈再表是我的專業,是我寫的程式。」我瞪了回去

「按盈再表晚上按,按不完,周六日再按。」

上完我的課應該會覺得時間突然多出來,

因等很久才會便宜,買了也要抱好幾年。

I asked him what his expertise was and he replied, "I specialize in On's table!" On's table is a program that I developed. I gave him a stern look and said, "You can review On's table in the evenings after work. If you don't finish it, please review it again on Saturdays and Sundays." After completing my course, you should feel like you have more time, and you need to be patient in waiting for cheap prices and holding onto stocks for many years.

只要聽到同學說「要當無業投資人」

我就知道高點到了,就去賣股票。

這個現象很準喔,

2017年漲到 1 萬點又有個傢伙說他不教了,要雲遊去,

這個傢伙4,000時很兢兢業業在教書,漲到 1 萬點就作怪了。

When I heard my student say, "I want to become an unemployed investor," I knew that the market had reached its peak and it was time to sell stocks. This phenomenon has been very accurate. In 2017, when the market reached 10,000 points, another guy who was teaching and earning 4,000 also said he wanted to quit teaching and go on an adventure. It's interesting to see how people's behavior changes when the market hits certain milestones.

我持股賣掉一半,

跌到7,000因QE把指數往上帶漲到9,000,

就有同學在他自己的部落格和噗浪網嘲笑我

GDP理論根本不準,而我卻仍然堅持,

同學笑說「GDP理論是國王的新衣。」

9,000點時我還預言股市將跌破7,000,

一位路人甲還在我的部落格留言「你還在等7,000點嗎?」

對我極盡羞辱。

後來真的跌破7,000這幾位仁兄即作鳥獸散,當作沒發生過一樣。

In 2008, when the index was at 4,000 points, I went all-in and held it until it reached 8,300 points in 2011. Then, I sold half of my shares. The index later dropped to 7,000 points, but the QE policy caused it to rise to 9,000 points. However, a student mocked me on his blog and Plurk.com, claiming that the GDP Theory was inaccurate, but I persisted. He called it the "king's new clothes". At 9,000 points, I predicted that the stock market would fall below 7,000 points. A passerby on my blog asked, "Are you still waiting for 7,000 points?" This was extremely humiliating. Later, when the index did drop below 7,000 points, those two guys disappeared without a trace, as if it had never happened.

同學問我「對這些不忠不孝孽徒的看法?」

我只能無奈「股市先知總是被白痴嘲笑!」

Some students asked me: "What do you think about these disloyal and ungrateful traitors?"

To which I replied, "Prophets are always mocked by fools in the stock market !"

講稿 1/21:歡迎 (Lecture 1/21 Welcome)- 講稿 2/21:知與不知 (Lecture 2/21 Knowable and unknowable)

- 講稿 3/21:巴六點 (Lecture 3/21 Buffett's Six Criteria)

- 講稿 4/21:物美價廉 (Lecture 4/21 Good quality and low price)

- 講稿 5/21:還原股價 (Lecture 5/21 Adjusted stock price)

- 講稿 6/21:高ROE (Lecture 6/21 High ROE)

- 講稿 7/21:配得出現金 (Lecture 7/21 High dividends)

- 講稿 8/21:會計 (Lecture 8/21 Accounting)

- 講稿 9/21:地雷股 (Lecture 9/21 Landmine stocks)

- 講稿 10/21:他們通通是錯的 (Lecture 10/21 They are all wrong)

- 講稿 11/21:不會變的公司 (Lecture 11/22 Durable)

- 講稿 12/21:多種果樹 (Lecture 12/21 Diversification)

- 講稿 13/21:IRR (Lecture 13/21 IRR)

- 講稿 14/21:殖利率陷阱 (Lecture 14/21 Yield trap)

- 講稿15/21:GDP理論 (Lecture 15/21 GDP Theory)

- 講稿 16/21:全世界都成立 (Lecture 16/21 Globally applicable)

- 講稿17/21:不要想太多 (Lecture 17/21 It's not that deep)

- 講稿 18/21:玩融資期貨選擇權是悲劇的開始 (Lecture 18/21 Margin trading, futures and options are the beginnings of a tragedy)

- 講稿 19/21:基金太貴,不做代操 (Lecture 19/21 Funds are too expensive, don’t manage other's funds)

- 講稿 20/21:股債不是蹺蹺板 (Lecture 20/21 Stock debt is not a seesaw)

- 講稿 21/21:技術分析真荒謬 (Lecture 21/21 Technical analysis is ridiculous)

沒有留言:

張貼留言

注意:只有此網誌的成員可以留言。