股票長期抱下來賺了多少錢怎麼算?

我在2003年35元買中碳,

一路抱到2007年股價83元,總報酬率多少?

是83/35-1?減 1 是扣掉本金,並不是!

How much profit was earned from long-term stock holdings? I purchased China Steel Chemical at NT$35 in 2003 and its price reached NT$83 in 2007. What is the total return? Is it calculated as (83/35) - 1, subtracting 1 to exclude the principal? No, this is not correct.

因為每年還有配股配息,加回去才是總共所賺的。

用現在股價把每年配股配息加回去就是還原股價,

再跟當年買的成本比較就是總共所賺的,

這是算報酬率最快的方法。

To calculate the total income from stocks, one must consider both dividends and stock splits received each year. The current stock price plus the annual dividends and stock splits forms the adjusted stock price. Comparing this adjusted price with the cost of purchasing the stocks in the past gives the total earnings. This is the most efficient method for calculating the rate of return.

我們買股票通常只記得哪一年買的,買在多少錢,

之後每年配了多少股票、股息都忘記了,

若臨時想算報酬率多少,最簡單的方法就用還原股價。

還原股價其實是除權除息的相反。

來複習何為除權除息?

When investing in stocks, people often only recall the year and the amount invested, but tend to forget the number of stocks and dividends received annually. To calculate the rate of return, the simplest approach is to adjust the stock price. This adjusted price takes into account the ex-dividend and ex-rights. Let's review what ex-dividends and ex-rights are.

除權除息之後股價會掉下來,

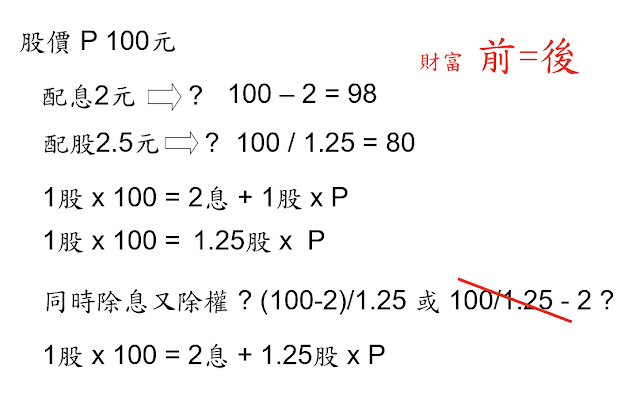

股價100元,配息2元,除息後股價是多少?

100 - 2 = 98。

The stock price will decrease after ex-dividends and ex-rights. If the stock price is NT$100 and the dividend is NT$2, what will the stock price be after ex-dividend?

100-2 = 98.

股價100元,配股2.5元,除權後股價多少?

配股2.5元指一股配2.5元股票,

股票面額10元,即每10元配2.5元股票,股票多了25%,

一張股票1,000股,除權之後變1,250股,

除權後股價是100/1.25 = 80。

The stock price is NT$100 and the stock dividend is NT$2.5. What will the stock price be after ex-rights? The allocation of NT$2.5 per share refers to a distribution of NT$2.5 per share. The stock denomination is NT$10, meaning that every NT$10 is allotted with NT$2.5 worth of stock, resulting in a 25% increase. After ex-rights, 1,000 shares of a stock will increase to 1,250 shares.

Stock price after ex-rights is 100/1.25 = 80.

請問為什麼要這樣算?

為何配息是用減的?配股用除的?

因為要維持股東財富在除權除息之前跟之後不變!

為何維持不變?

因為只是把賺的錢分配出來,財富不會因此而增加。

Why do we calculate it this way? Why subtract for cash dividends and divide for stock dividends? This is to maintain the shareholders' wealth unchanged before and after ex-dividends and ex-rights. Why keep it unchanged? Because dividends only represent the distribution of earnings and do not result in an increase in wealth.

除息前股數 1 股,股價100元,

除息之後分到2元股息,股數還是 1 股,股價P是多少?

1股 x 100 = 2息 + 1股 x P

Before ex-dividend, there was 1 share and the stock price was NT$100. After ex-dividend, a dividend of NT$2 was distributed, and the number of shares remained at 1. What is the new stock price (P)?

1 share x 100 = NT$2 dividend + 1 share x P

除權前 1 股,股價100元,

除權後變成1.25股,股價多少?

1股 x 100 = 1.25股 x P

Before ex-rights, there was 1 share and the stock price was NT$100. After ex-rights, the number of shares increased to 1.25. What is the new stock price (P)?

1 share x 100 = 1.25 shares x P

若同一天除權又除息,請問答案是?

1. (100-2)/1.25

2. 100/1.25 -2

答是 1.

因為除權除息前 1 股,股價100元,

除息後分到2元股息,除權股數變成1.25股,所以股價多少?

1股 x 100 = 2息 + 1.25股 x P

If ex-rights and ex-dividends are on the same day, what is the answer ?

1. (100-2)/1.25

2. 100/1.25 -2

The answer is 1.

Because 1 share before ex-dividend, stock price is NT$100,

After ex-dividend, a dividend of NT$2 is distributed, and number of ex-rights shares becomes 1.25 shares, so what is stock price P ?

1 share x 100 = 2 dividend + 1.25 shares x P

下一題,

除權前股東財富100元,配股2元後財富增加多少?

沒增加!股東財富不會因為除權除息而增加。

What is the change in shareholder wealth after a rights issue of NT$2 if it was originally NT$100 before ex-rights?

Answer: No change. Shareholder wealth will remain the same before and after the ex-rights and ex-dividends.

若財富未增加,請問為何要除權除息呢?不就沒意義嗎?

除權除息的目的在確認誰有資格來領取這些股利。

股票每天在市場上交易來交易去,

股票在誰手上公司也搞不清楚,股利發給誰?

所以得確定一天,即除權除息交易日,

抱超過這一天就有資格領股利。

If wealth has not increased, why do we have to ex-rights and ex-dividend? Isn't it meaningless?

The purpose of ex-rights and ex-dividends is to identify who is eligible to receive dividends. Since stocks are traded on the market every day, the company cannot always keep track of who owns the stock and who should receive the dividends. Therefore, a specific day, known as the ex-rights and ex-dividend trading day, is established. Only those who hold the stock on or before this day are eligible to receive the dividends.

至於股價上漲並非因除權息才漲的,

而是公司每天一點一滴在賺錢的過程中就在反應。

大立光股價漲到6千元,不是因除權息才漲的,

而是業績越來越好就在反應。

The increase in stock prices is not attributed to ex-dividends. Rather, stock prices are gradually reflected every day as a result of the company's financial performance. The rise in Largan's stock price to NT$6,000 is not due to ex-dividend, but rather it is a response to better performance of the company.

再來,

請問EPS10元,配息2元、股票股利2.5元之後

有多少錢留在公司裡?

One more question.

EPS NT$10, after ex-dividends of NT$2 and ex-rights of NT$2.5.

How much money is left in the company ?

除息是把保留盈餘配出來的意思。

除權則把保留盈餘變成股本,

在除權除息表可以看到兩個名詞盈轉跟資轉。

盈轉是盈餘公積轉增資,資轉為資本公積轉增資。

所謂轉增資就是轉成股本,

這只是會計科目的移轉,並沒有真的把錢配出來,

錢仍然在公司手上。

除息才真的有把錢配出來,所以8元留在公司。

Ex-dividend means distributing retained earnings, while ex-rights convert retained earnings into equity. In the ex-dividend table, you will see the terms earnings transfer and capital transfer. Earnings transfer refers to the transfer of retained earnings to capital increase, while capital transfer refers to the transfer of capital surplus to capital increase. This is just an accounting transfer and does not actually distribute the money, it remains in the possession of the company. Only ex-dividends actually distribute the money, so NT$8 remains in the company.

美股沒有除權,而是拆股,

1 股拆成2股寫成2:1,唸成two for one。

1:1是未拆。

Stock divide is referred to as a split in the US stock market. A 2:1 split means that one share is divided into two shares. On the other hand, a 1:1 split indicates that there is no division of shares.

為何要拆股?

股價太高沒人買得起,流通性差,本益比會低。

身為股東都希望股票的本益比越高越好,

此時公司即會拆股。

蘋果電腦股價漲到700多元時 1 股拆成7股,

股價掉到100元,股價比較會漲。

Why is stock splitting done? When a stock's price is too high and becomes unaffordable, leading to poor liquidity and low price-to-earnings ratio (PER), the company may choose to split its shares. Shareholders generally prefer a higher PER for their stocks. For example, when Apple's stock price rose above $700, a 1:7 split was done. This helps to increase the relative stock price if it drops to $100.

請問除息之後本益比將上升或下降?

除權之後本益比上升或下降?

Will the PER increase or decrease after the ex-dividend date?

What will be the change in the PER after the ex-rights date?

本益比 = 股價÷EPS,除息股價要減2元,

EPS呢?不用減2元,因為是不一樣的錢,

EPS是今年預估要賺的錢,

股息則是去年賺的錢今年配出來,

兩者是不同的錢,

所以除息EPS不必減2元,本益比會下降!

PER = stock price ÷ EPS

After the ex-dividend date, the stock price will decrease by NT$2. However, the EPS will not be affected by this decrease as it represents the estimated profit for the current year, whereas the dividend represents the profit earned from the previous year that is being distributed in the current year. These are two different types of money. Therefore, the EPS will not need to be reduced by NT$2 and the PER will decrease.

除權之後股價÷1.25,EPS÷1.25呢?

要!因為股數增加,所以除權之後本益比不變。

Stock price ÷ 1.25 after ex-rights, and what about is EPS ÷ 1.25 ?

Yes! Due to an increase in the number of shares, the PER will remain unchanged after the ex-rights date.

除息之後本益比會下降,正因如此

每年在5-6月除權息旺季時市場流行高現金殖利率股。

After the payment of dividends, the PER will decrease. This is the main reason why stocks with high cash dividends are highly sought after in the market during the ex-dividend season, which occurs from May to June each year.

現金殖利率即股息÷股價,

高現金殖利率表示股息配得多或股價低。

我在2008年24元買大統益,

因為它之前股息至少配2.4元,現金殖利率10% ,

10%是非常高,殖利率有4%就算高。

當時正值金融風暴,大統益做沙拉油的,

想再怎麼不景氣總是要吃吧。

2008年買抱到現在,大統益給我年複利22%,相當不錯。

Cash yield is dividend ÷ stock price.

A high cash yield means a higher dividend or a lower stock price. I purchased TTET Union at a price of NT$24 in 2008 because of its dividend of at least NT$2.4 and a cash yield of 10%, which was significantly higher than the market's expected yield of 4%. TTET Union was in the business of producing salad oil, which is a staple food item that is consumed regardless of economic conditions. Since purchasing TTET Union in 2008, I have received a 22% annual compound return, which has been a great investment.

像大統益這種不受景氣影響,

賺了錢大半配息的股票稱為定存股。

超商和電信股也是。

Similar to TTET Union, stocks that are not affected by economic downturns and pay high dividends are commonly referred to as "defensive stocks." Examples of these types of stocks include supermarkets and telecommunications companies. These are often referred to as "fixed deposit stocks" stocks, as they provide a consistent source of income through their dividends.

定存股有明確定義,獲利不受景氣影響而且配息率高的才是。

有些人把原料股、散裝輪等景氣循環股都當成定存股,

實在不求甚解。

Fixed deposit stocks have a clear definition: they must be profitable without being impacted by economic conditions and have a high dividend payout ratio. Some individuals may consider cyclical stocks such as raw materials and shipping stocks to be fixed deposit stocks, but this is a misunderstanding as these types of stocks are often impacted by economic cycles. It is important to have a thorough understanding of these investments before making a decision.

問題6:配股跟配息哪一種對股東比較好?

現在大家認為配息較好,因被我洗腦過了,早年台股喜歡配股。

配息配股何者較好答案不一定,看能否維持高ROE而定。

若保證可以維持高ROE,應該配股,

這麼會賺錢就不用把現金配出來,

繼續幫我們賺錢,複利效果才高。

Question 6: Which is better for shareholders, stock dividends or cash dividends?

It depends on the company's ability to maintain a high ROE (return on equity). If the company can maintain a high return on equity, it may be better to distribute stock dividends instead of cash dividends. This way, the company can continue to help its shareholders make money, and the compound interest effect will be high.

若無法維持高ROE則當把現金配出來,

讓股東再去找其它投資標的。

If the company is unable to maintain a high ROE, it is recommended to pay dividends so that shareholders can explore other investment opportunities.

一直都配不出現金的公司不容易長期維持高ROE,

因淨值越吃越胖,除非能一直成長,但成長有其極限。

A company that can't pay cash dividends will have difficulty maintaining a high ROE in the long run. The net worth will get bigger as it eats more, unless it can keep growing, but growth has its limits.

問題7是現金增資之後股價怎麼算,

問題8是減資,

問題9是買回庫藏股,

這3個問題原理都一樣,之前跟之後股東財富不變,

請自行回去研究。

Question 7 deals with the calculation of stock price after a rights issue.

Question 8 is about the return of capital.

Question 9 involves the purchase of treasury stocks.

These three questions share the same underlying principle, which is that the wealth of shareholders remains unchanged before and after.

Please research on your own.

問7:股價100元,現增溢價80元,新股10%,

現增後股價為何 ?

答:1 x 100 + 0.1 x 80 = 1.1 x P

Question 7: Stock price is NT$100, rights issue premium is NT$80, and the proportion of new shares is 10%.

What is stock price P after price increase ?

Answer: 1 x 100 + 0.1 x 80 = 1.1 x P

問8:晶華減資72%後股價如何計算 ?

答:減資前1股 x 減資前股價108元 =

退還股本7.2元 + 減資後只剩0.28股 x 減資後股價362元

Question 8: How will the share price of Regeant Hotel be calculated after a 72% return of capital?

Answer: 1 share prior to return of capital x stock price before return of capital at NT$108 = returned capital of NT$7.2 + 0.28 remaining shares after return of capital x stock price after return of capital at NT$362.

問9:買回庫藏股前股價100元,註銷後股價為何 ?

答:註銷後後仍是100元,1股 x 100 = 1股 x 100

Question 9: What is the stock price after cancellation, when the stock price was NT$100 before the repurchase?

Answer: The stock price remains at NT$100 after cancellation, as 1 share x 100 = 1 share x 100.

問題10是要不要參加除權除息?

Question 10 Is it worth participating in ex-dividend ?

每年在5-6月除權除息旺季都有同學在問,

我認為可以參加,因為稅沒想像中的重。

假設買的股票現金殖利率6%,

所得稅率20%,僅需繳1.2%的税。

即便再把健保補充費把加上去,

健保補充費課股息2%,

6%x2% = 0.12%,比手續費0.1425%還少。

合計繳稅不到1.4%,比基金管理費2-3%低。

During the ex-dividend season from May to June, students frequently raise the question of whether participation is worthwhile. The tax burden is not as significant as it may appear. With a 6% cash yield on the purchased stock and a 20% income tax rate, only a 1.2% tax is required. The addition of a 2% dividend for health insurance supplementary premium brings the total tax amount to less than 1.4%, which is lower than the typical 2-3% fund management fee. The 6% multiplied by 2% equates to 0.12%, a figure that is less than the 0.1425% commission.

股票長期抱下來有沒有賺到錢不要光去看K線圖,

因很容易被誤導。

這是鴻海的K線圖,2000年股價達到最高375元,

之後一路跌到2006年204元,

買在最高點的人一定以為賠錢,可是並非如此,

把204元還原回去是622.4元,仍然賺很多錢!

有沒有賺錢不要光看K線圖,看還原股價才是。

Can you earn a profit by holding stocks for the long term? Don't solely depend on the candlestick chart, as it can be misleading. For example, examine Hon Hai's chart. In 2000, its stock price reached its highest point at NT$375, but later dropped to NT$204 in 2006. Although it might seem like a loss, the adjusted price of NT$204 is actually NT$622.4, resulting in substantial gains. To accurately evaluate your profits, examine the adjusted stock price instead of relying solely on the candlestick chart.

同學拿到盈再表時可以做驗證,看我講的話對不對?

我的主張很簡單,就是高ROE,股價便宜去買,

長期抱下來,保證可以賺到錢。

這個主張光聽我講:

我2001年買億豐窗簾,抱到2007年被外資併購賺了3倍。

2002年買國碁,被鴻海併購,抱到了2010年150元賣掉賺3倍。

2003年買中碳8年賺6倍。

2008年買台積電、大統益、巨大,8年賺4倍。

2011年買和泰車、2012年買美利達都一年賺2倍。

2011年買茂順2年賺 1 倍。

2013年買GD、標準普爾(MHFI)、UNH 2年賺 1 倍。

底下這張圖即我的漲倍圖

When you download the On's table, please verify that my information is correct. My strategy is straightforward: a high ROE, cheap prices, and long-term holding can secure profits. As proof, I bought Nienmade (8464.TW) in 2001 and held it until it was acquired by foreign investors in 2007, resulting in a 3x profit. In 2002, I bought Ambit Microsystems (2386.TW) and held it until its acquisition by Hon Hai in 2010, yielding another 3x profit. In 2003, I invested in China Steel Chemical and made 6x over 8 years. In 2008, I bought shares in TSMC, TTET Union, and Giant (9921.TW), earning 4x over 8 years. I acquired Hotai Motor (2207.TW) in 2011 and Merid (9914.TW) in 2012, resulting in a 2x profit. In 2011, I bought NAK (9942.TW) and made 1x in two years. In 2013, I invested in General Dynamics (GD), Standard & Poor's (MHFI), and UnitedHealth Group Incorporated (UNH) within two years, earning 1x. The graph below shows my multibaggers.

光聽我說,買什麼幾年賺幾倍,可能是我在吹牛,

同學務必自己驗證看看:

盈再表的右邊有一張歷史股價表,上頭有年複利,

買在8年前最低價抱到現在,年平均複利是多少。

Just listen to what I have bought in the past few years and earning several times the money may seem like bragging. It's important to verify it for yourself. On's table on the right displays a historical stock price table with annual compound return. What is the average annual compound return, purchased at the lowest price, from 8 years ago to the present?

大統益買在2009年最低價23.8元抱到現在8年平均複利22%,

大統益平常不被注意的股票,年複利竟然高達22%。

I purchased TTET Union at its lowest price of NT$23.8 in 2009 and have achieved an average compound return of 22% over the past 8 years. Often overlooked stocks can deliver annual returns as high as 22%.

波克夏也一樣,

買在第一年2009年最低價抱到現在8年平均複利17%。

The same holds true for Berkshire. If you bought at the lowest price in 2009, and the average return has remained at 17% over the past 8 years.

看歷史股價,大家應會得出同樣結論,

只要高ROE,股價便宜買,長期抱下來,一定可以賺到大錢。

如果選高ROE的股票,在便宜時進去買,

結果卻沒有賺到錢,問題出在哪裡?

抱得不夠久!

我們當分析師很會推卸責任,

如果買我推薦的股票沒賺到錢,不是我的問題喔,

而是抱得不夠久。

Examining historical stock prices, it becomes evident that a combination of high ROE, cheap stock prices, and a prolonged holding period can lead to substantial profits. If no money was made despite choosing high ROE stocks and purchasing them at a cheap price, the problem likely lies in a short holding duration. As analysts, we tend to deflect responsibility, but if you don't make money from the stocks I recommend, it is not my fault. The crucial factor is the length of the holding period.

回顧還原股價是我學巴菲特的開始,

為何從一個外資電子股分析師轉過頭來學巴菲特?

以前常常把買過的股票還原股價拿出來算,

那些股票當時都自以為每個波段都做得很漂亮,

可是看到還原股價都搥心肝,

後悔倒不如從頭抱到尾還賺更多。

如何才能從頭抱到尾?

是一門大學問啊!

Reflecting on adjusted stock prices marked the beginning of my learning about Buffett. I was inspired to learn about Buffett from an electronics analyst at a foreign securities company. I used to regularly calculate the adjusted stock prices of the stocks I purchased and was confident in my market timing skills. However, now, upon reviewing those adjusted stock prices, I feel remorseful. I have come to understand that it would have been more advantageous to hold onto the stocks from start to finish for greater returns. The challenge remains, how can I maintain a long-term hold on my stocks? This is a significant challenge.

我推薦買台積電,同學都說這沒什麼學問啊,

全台灣的人都知道它好,

可是從頭抱到尾才能賺到大錢,

我2008年43元買抱到240元就是一門大學問。

I recommend purchasing TSMC. My students say it's not a big deal and everyone in Taiwan knows it's a good company. However, you need to hold onto TSMC for a long time to make substantial profits. I bought it at 43 TWD in 2008 and held onto it until it reached 240 TWD, that's the real challenge.

同學對我的方法產生質疑時,

請去看一下歷史股價那張表,

保證這絕對是真理。

When you question my approach, please review historical stock prices. I can assure you that this is a proven fact.

講稿 1/21:歡迎 (Lecture 1/21 Welcome)- 講稿 2/21:知與不知 (Lecture 2/21 Knowable and unknowable)

- 講稿 3/21:巴六點 (Lecture 3/21 Buffett's Six Criteria)

- 講稿 4/21:物美價廉 (Lecture 4/21 Good quality and low price)

- 講稿 5/21:還原股價 (Lecture 5/21 Adjusted stock price)

- 講稿 6/21:高ROE (Lecture 6/21 High ROE)

- 講稿 7/21:配得出現金 (Lecture 7/21 High dividends)

- 講稿 8/21:會計 (Lecture 8/21 Accounting)

- 講稿 9/21:地雷股 (Lecture 9/21 Landmine stocks)

- 講稿 10/21:他們通通是錯的 (Lecture 10/21 They are all wrong)

- 講稿 11/21:不會變的公司 (Lecture 11/22 Durable)

- 講稿 12/21:多種果樹 (Lecture 12/21 Diversification)

- 講稿 13/21:IRR (Lecture 13/21 IRR)

- 講稿 14/21:殖利率陷阱 (Lecture 14/21 Yield trap)

- 講稿15/21:GDP理論 (Lecture 15/21 GDP Theory)

- 講稿 16/21:全世界都成立 (Lecture 16/21 Globally applicable)

- 講稿17/21:不要想太多 (Lecture 17/21 It's not that deep)

- 講稿 18/21:玩融資期貨選擇權是悲劇的開始 (Lecture 18/21 Margin trading, futures and options are the beginnings of a tragedy)

- 講稿 19/21:基金太貴,不做代操 (Lecture 19/21 Funds are too expensive, don’t manage other's funds)

- 講稿 20/21:股債不是蹺蹺板 (Lecture 20/21 Stock debt is not a seesaw)

- 講稿 21/21:技術分析真荒謬 (Lecture 21/21 Technical analysis is ridiculous)

沒有留言:

張貼留言

注意:只有此網誌的成員可以留言。